2025: A year of momentum, milestones, and our outlook for 2026

2025 was an exciting and transformative year, marked by growth, new partnerships, continuous product enhancements, and meaningful engagement across the financial industry. Looking ahead, we are focused on helping clients enhance risk-based performance and streamline processes, with several exciting updates planned for 2026.

New projects and clients

We were proud to welcome several new clients and pilot projects, including collaborations with 6 Monks and Private Client Bank. These partnerships reflect the growing trust in our solutions across the financial sector. Our models are also used by a large Swiss cantonal bank for an AI-supported Swiss Equity Basket.

Industry presence and thought leadership

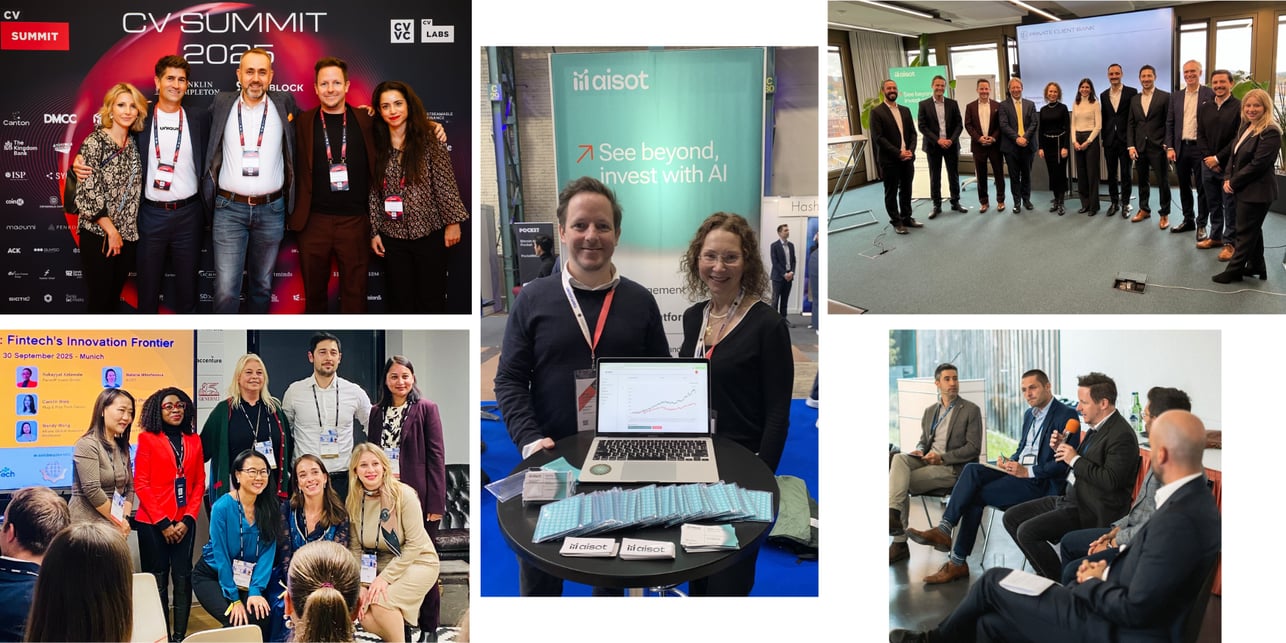

We attended Finanz 2025 and are already looking forward to returning for the 2026 exhibition. Our Co-Founder and CEO, Stefan Klauser, shared insights on AI in wealth management at WEF 2025, Digital Assets Forum 2025, CV Summit 2025, and DKF Luxembourg 2025.

In Munich, Nino Antulov-Fantulin, Co-Founder and Head of R&D, and Sara Asani, Business Development, showcased aisot's AI Insights Platform at Bits & Pretzels 2025, Munich's largest founder festival.

Our first event in Luxembourg, in collaboration with the Luxembourg Stock Exchange (LuxSE), TRG Screen, BIQH, and Exchange Data International (EDI), featured Stefan Klauser discussing how AI can drive performance, precision, and innovation in fund management and portfolio optimization.

Hosting an AI innovation breakfast

In collaboration with Private Client Bank, Aisot Technologies co-hosted an exclusive AI Innovation Breakfast at the ETH AI Center. The event focused on the thoughtful integration of artificial intelligence into wealth management. The consensus was clear: AI amplifies rather than replaces traditional expertise – accelerating research, enhancing portfolio analysis, delivering predictive insights, and identifying risks earlier.

Celebrating 2 years of our AI Digital Assets Strategy

October 2025 marked the 2-year anniversary of our AI Digital Assets strategy, which has returned +261% since October 3, 2023 (past performance is no indicator of future performance). The strategy invests in a systematic basket of 21 crypto assets, managed using portfolio optimization and AI-driven predictions from our AI Insights Platform. Learn more about the strategy here.

As a SaaS provider, we enable systematic investment strategies without managing assets ourselves. We count on a large partner network to launch AI optimized investment strategies for our clients.

Recognition and community

2025 also brought important recognition. We were accepted into the Microsoft Switzerland AI Tech Accelerator Community and the Amazon Web Services (AWS) Migration Acceleration Program and were honored to be among the winners of the IMD Start Competition, milestones that further validate our vision and impact.

Looking ahead to 2026

As we look ahead to 2026, we are well positioned to grow and to help our clients improve risk-based performance, save valuable time on manual tasks, and focus on what matters most: delivering better outcomes for their clients.

We have several exciting updates in our pipeline, including a chat-based interface for our aisot AI Insights Platform, designed to make the user experience as well as reporting even smoother and more intuitive. In addition, we are extending our capabilities from backtesting to live portfolio analysis and alerting, enabling deeper insights and better support for portfolio optimization and position sizing based on risk.

We remain committed to pushing the boundaries of AI in asset management, continuously improving our platform through close collaboration and feedback from both clients and prospective clients.

Thank you

We would like to thank all our partners and supporters for their trust and collaboration throughout 2025, and we wish everyone a successful and inspiring 2026.