Agentic AI Arrives on the Aisot Insights Platform

ZURICH / LONDON, 06.02.2026 — Aisot Technologies, the ETH Zurich spin-off specializing in AI-driven...

Since the 1950s, there has been a gradual increase in stock market volatility, leading many market observers and participants to believe that 'volatility is here to stay'. While market volatility isn't always negative, it's crucial to protect portfolios from significant drawdowns.

Market participants have varying levels of risk tolerance, but family offices often prioritize wealth preservation. Despite differences in investment styles, asset classes, and strategic or tactical allocations, there's a common goal to minimize downside volatility. This approach can be likened to surfing the market's upward trends while skillfully avoiding financial wipeouts.

Traditionally, risk reduction in portfolio management has relied on quantitative elements like volatility, Value at Risk, and classic factor models.

However, the emergence of automated analysis of large datasets and modern Machine Learning technology is reshaping this approach. While aisot still considers traditional metrics like the volatility of individual assets, mutual dependence, and factor models for estimating portfolio risk, it now incorporates additional data from market and alternative sources. This includes integrating innovative risk methods that combine next-generation Machine Learning-based forecasting with advanced covariance estimators.

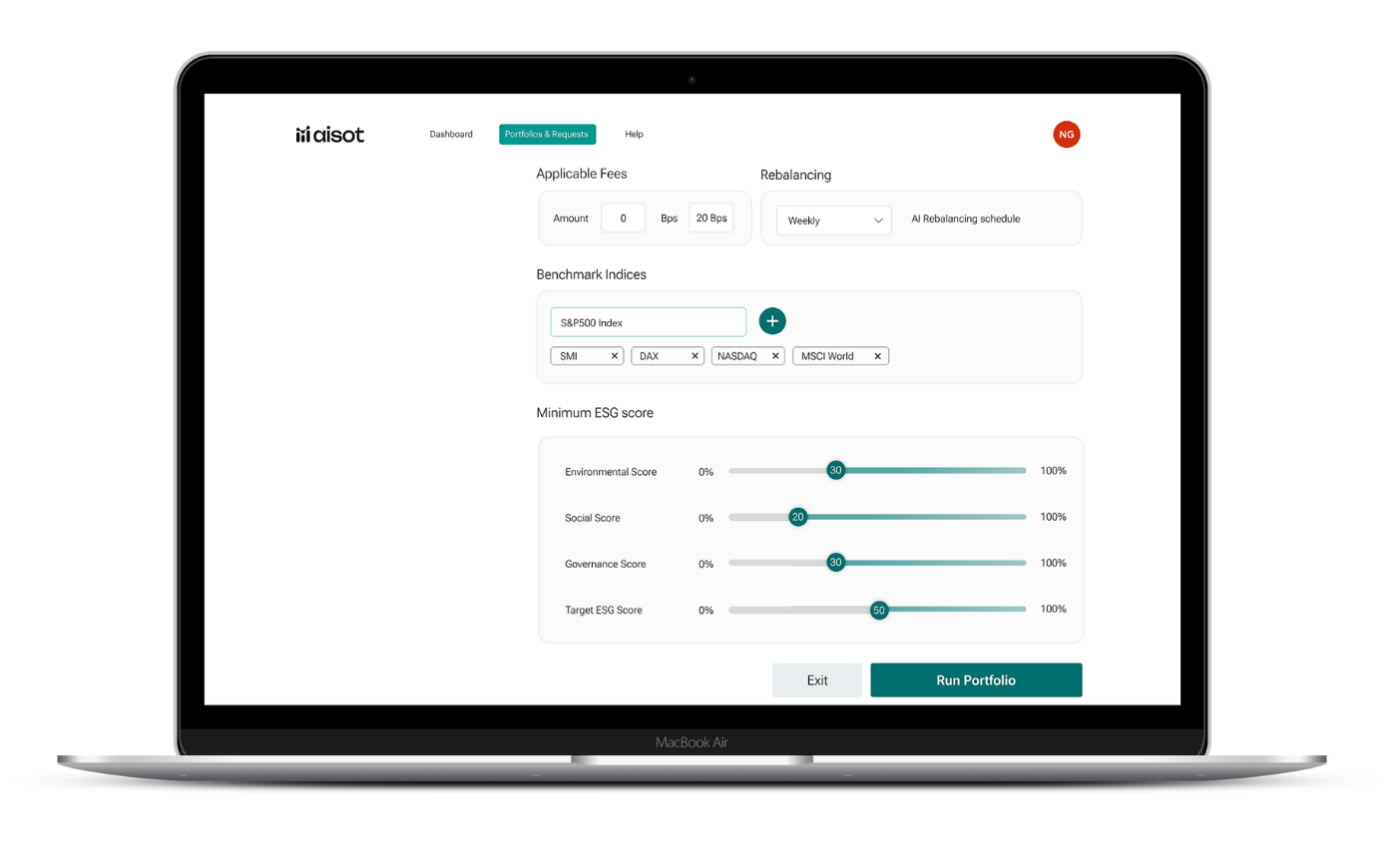

Backtesting period & benchmark selection on the AI Insights Platform.

Volatility target & instrument selection on the AI Insights Platform.

Aisot Technologies equips Family Offices with an AI-driven platform for crafting tailored investment strategies, emphasizing downside risk protection. The aisot AI Insights Platform simplifies portfolio management across diverse markets, offering advanced tools for risk evaluation, Machine Learning, and quantitative strategies, enhanced by comprehensive backtesting. It streamlines the investment process, reduces research costs, and enables effective investment decision-making with detailed insights into security selection and market opportunities. Additionally, the platform's Product Launchpad facilitates the quick creation of custom financial products, offering significant time and cost efficiencies. Aisot also provides full portfolio management services, ensuring a seamless experience in customized financial product development and management.

Subscribing to the platform grants users access to the following features:

ZURICH / LONDON, 06.02.2026 — Aisot Technologies, the ETH Zurich spin-off specializing in AI-driven...

AI is reshaping how institutional investors work. At a World Economic Forum roundtable in Davos,...

2025 was an exciting and transformative year, marked by growth, new partnerships, continuous...