Agentic AI Arrives on the Aisot Insights Platform

ZURICH / LONDON, 06.02.2026 — Aisot Technologies, the ETH Zurich spin-off specializing in AI-driven...

The information in this website was prepared by Aisot Technologies AG for information and marketing purposes. However, Aisot Technologies makes no representation or warranty with respect to its contents or completeness and disclaims any liability for loss or damage of any kind incurred directly or indirectly through the use of this document or the information contained herein. All opinions expressed in this document are those of Aisot Technologies at the time of writing and are subject to change without prior notice. Unless otherwise stated, all figures are unaudited. This document is for the information of the recipient only and does not constitute investment advice, an offer or a recommendation to purchase financial instruments and does not release the recipient from his or her own evaluation and judgement. This document is explicitly not intended for persons whose nationality, place of residence or other characteristics prohibit access to such information due to applicable legislation.

Every investment involves risks, particularly those of fluctuations in value and income. Collective investments are volatile and an investment may result in the total loss of the capital invested. Furthermore, performance data does not account for the commissions and costs that may be charged on issue and/or redemption. Furthermore, it cannot be guaranteed that the performance of comparable indices will be achieved or exceeded. A positive performance in the past or the indication of such a performance is no guarantee for a positive performance in the future. Investments in foreign currencies may be subject to currency fluctuations. There is an additional risk that the foreign currency may lose value against the investor's reference currency.

The content provided by aisot is intended solely for natural personas and legal entities that are resident or have their registered office in Switzerland. More particularly, such content and functions are not intended for any person or entity who is subject to jurisdictions which prohibit to publish, supply or access information by aisot (e.g. due to the user's nationality or residence or on other grounds). Persons to whom these restrictions apply are not permitted to access information by aisot.

In today's dynamic and unpredictable investment environment, institutional and professional investors face substantial challenges. The quest for consistent returns, risk mitigation, and market navigation requires not just expertise but also advanced tools. Amid these complexities, aisot introduces the Sentinel US Equity ESG strategy, offering a transformative approach to achieving financial success while aligning with contemporary ethical standards thanks to an ESG filter eliminating ESG laggards. This state-of-the-art investment instrument is tailored to meet the sophisticated needs of professional investors, leveraging cutting-edge AI technologies to redefine portfolio management. By selecting the twenty most widely held U.S. stocks through a rule-based approach, this portfolio ensures comprehensive industry exposure and diversification.

The Sentinel line of investment products, including the U.S. Equity, incorporates Large Language Models (LLMs) to capture market sentiment. The Sentinel U.S. Equity ESG strategy employs a rule-based selection of the twenty most widely held U.S. stocks, ensuring diversified exposure across leading industries. With up to 15 holdings at any given time, filtering out ESG laggards, and dynamically incorporating up to a 50% cash component to manage volatility, the portfolio leverages sophisticated machine learning and quantitative techniques, along with advanced LLM sentiment analysis. Rebalanced monthly, Sentinel U.S. Equity aims for long-term capital appreciation and risk mitigation. Join the waiting list today and be among the first to leverage AI-driven market sentiment for optimized growth and stability.

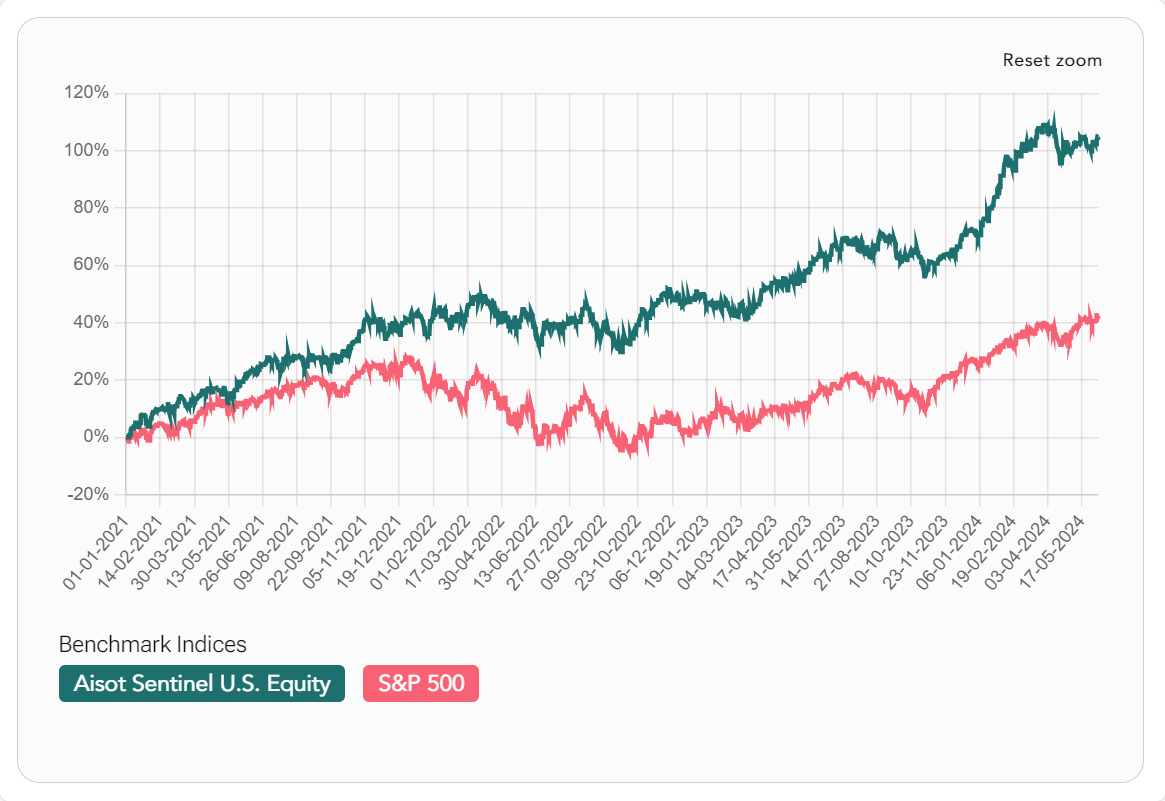

The performance of the aisot Sentinel US Equity ESG portfolio speaks for itself. The optimized strategy outperforms an equally-weighted portfolio by approximately 7.5% annually, generating an alpha of 3bps daily. This consistent outperformance underscores the tangible benefits of AI-driven investment strategies.

01 January 2021 - Monday, 10 June 2024, back-tested results, net of trading fees

| aisot Sentinel U.S. Equity | S&P 500 | |

| Sharpe Ratio A | 1.5263 | 0.6938 |

| Sortino Ratio A | 2.2764 | 0.9937 |

| Max Drawdown | -0.1309 | -0.2543 |

| Annualized Volatility | 0.1440 | 0.1693 |

| Annualized Return | 0.2328 | 0.1086 |

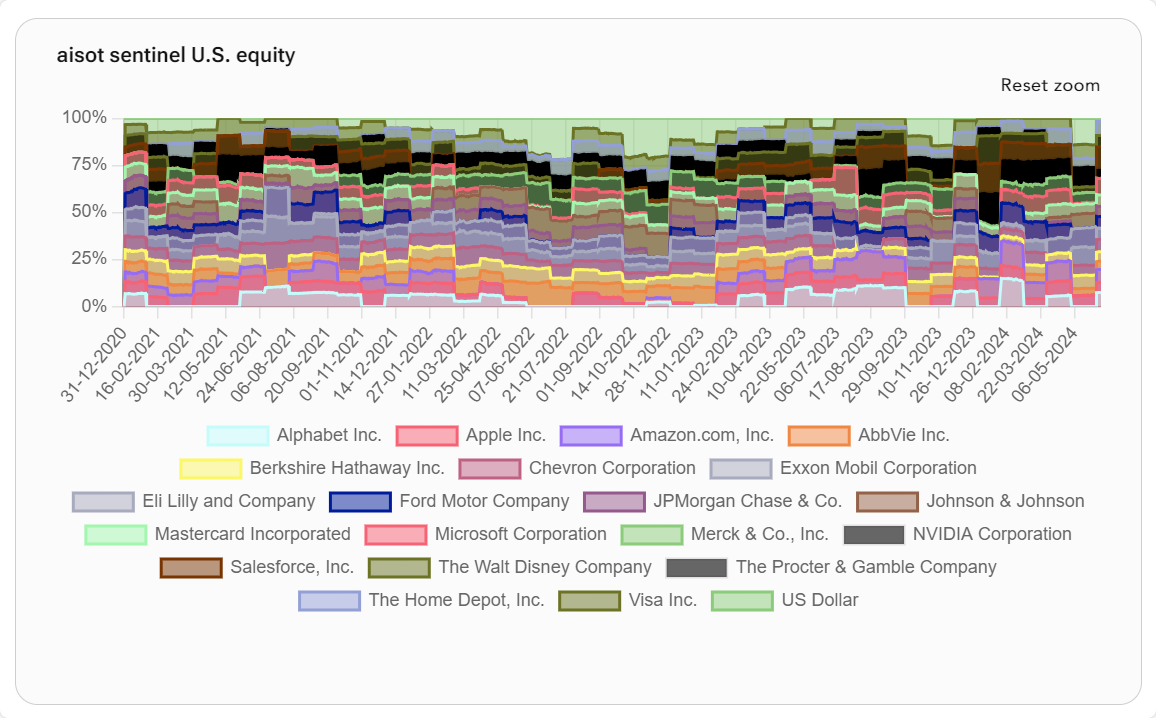

Historic portfolio composition: 01 January 2021 - Monday, 10 June 2024

Agile & responsive: Utilizing machine learning, quantitative techniques, and the latest LLM sentiment analysis, the certificate's portfolio weights are dynamically optimized. A monthly rebalancing mechanism ensures agility and responsiveness to market shifts, maintaining optimal performance.

Utilizes advanced LLMs to capture and analyze market sentiment.

Selects the twenty most widely held U.S. stocks, ensuring diversified exposure across leading industries.

Maintains up to 15 holdings at any given time for optimized portfolio management.

Employs a dynamic strategy that can include up to a 50% cash component to manage market volatility.

ESG filter to eliminate ESG “laggards”, aligning with contemporary ethical standards.

The portfolio is rebalanced monthly to maintain optimal alignment with investment goals.

Aims for long-term capital appreciation and risk mitigation.

ZURICH / LONDON, 06.02.2026 — Aisot Technologies, the ETH Zurich spin-off specializing in AI-driven...

AI is reshaping how institutional investors work. At a World Economic Forum roundtable in Davos,...

2025 was an exciting and transformative year, marked by growth, new partnerships, continuous...