Agentic AI Arrives on the Aisot Insights Platform

ZURICH / LONDON, 06.02.2026 — Aisot Technologies, the ETH Zurich spin-off specializing in AI-driven...

Active Funds share a list of collective challenges: shrinking margins, regulatory and reporting duties and competition from low-cost index products. They are under significant pressure to maintain cost-efficiency and deliver strong investment performance for clients. Achieving market-comparable risk-adjusted returns, while also maintaining a unique investment style and approach and handling regulatory requirements, pose significant hurdles to modern funds.

On top of that, despite differences in investment styles, asset classes, and strategic or tactical allocations, there's a common need to minimize downside volatility. Ultimately, clients demand high-quality service, tailored products that yield results, and all at a competitive price. The complexity and extra workload of reporting processes, combined with unpredictable market conditions, further complicate forward planning for these firms.

Active funds, grappling with strict regulations, market volatility, and intensive reporting demands amidst declining margins, find a new ally in Machine Learning (ML) and automated data analysis technologies. These advancements are revolutionizing the sector by facilitating the effortless incorporation of investment restrictions and optimizing portfolio management efficiently. This shift not only minimizes the resource and time investment traditionally required but also allows funds to uphold their distinctive investment strategies. Moreover, the integration with automated, compliant reporting tools streamlines regulatory processes at a minimal extra cost, positioning active funds favorably in a competitive market landscape.

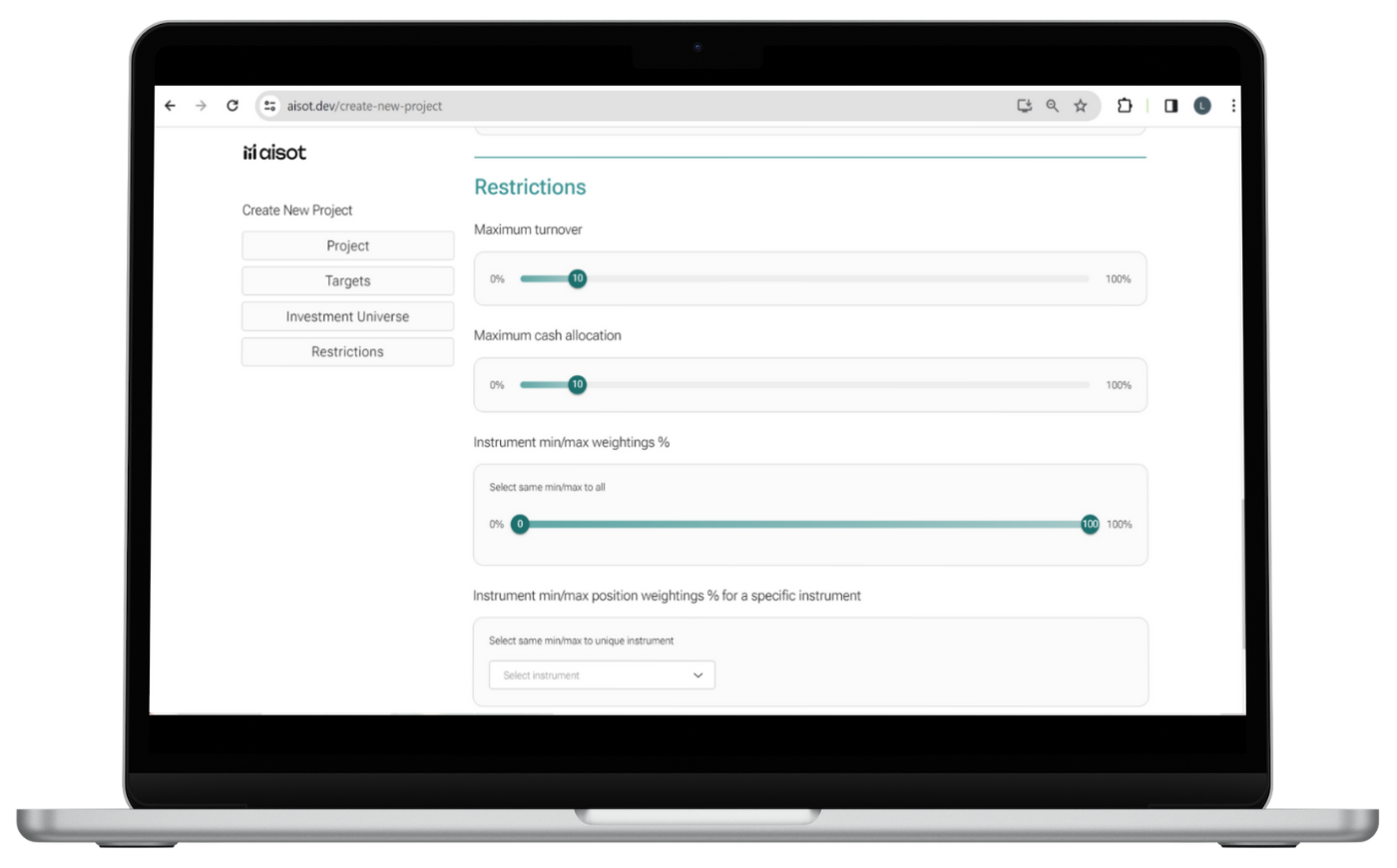

Restrictions selection on the AI Insights Platform.

Performance & portfolio composition view on the AI Insights Platform.

Aisot Technologies revolutionizes fund management with our aisot AI Insights Platform, offering tailored investment strategies and advanced downside protection. Harness the power of AI for portfolio optimization across diverse markets, with tools for rapid prototyping, Machine Learning, quant strategies, and comprehensive backtesting. Our platform boosts efficiency, cuts research costs, and delivers superior investment outcomes, even under tight constraints. Gain insights into security selections, discover new opportunities with our analytics tools, and leverage our Product Launchpad for easy financial product securitization. With the option to delegate portfolio management to aisot and our partners, we provide a full suite of solutions for custom financial product development and management.

Subscribing to the platform grants users access to the following features:

ZURICH / LONDON, 06.02.2026 — Aisot Technologies, the ETH Zurich spin-off specializing in AI-driven...

AI is reshaping how institutional investors work. At a World Economic Forum roundtable in Davos,...

2025 was an exciting and transformative year, marked by growth, new partnerships, continuous...