Agentic AI Arrives on the Aisot Insights Platform

ZURICH / LONDON, 06.02.2026 — Aisot Technologies, the ETH Zurich spin-off specializing in AI-driven...

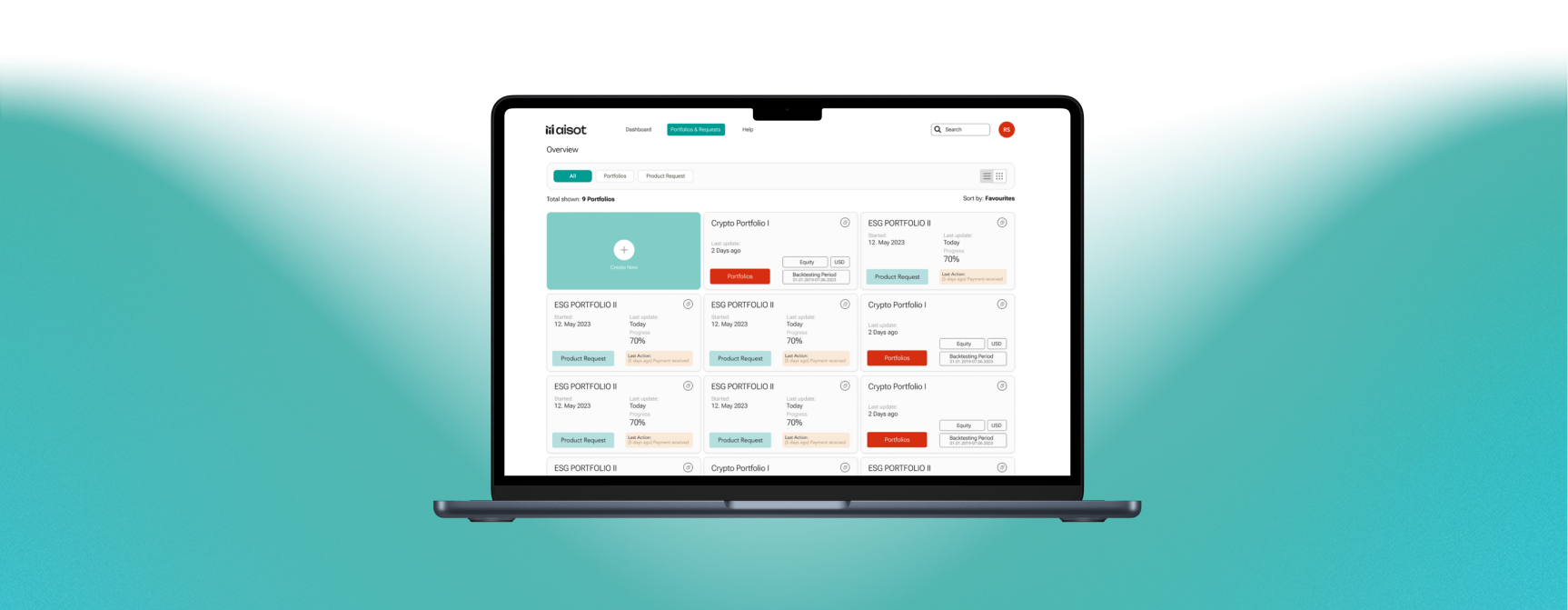

aisot's proprietary AI platform allows Asset Managers, Financial Advisors & Brokers to generate portfolios that can not only reflect customer preferences in stock and cryptocurrency markets at any given time but also optimize investment decisions through AI and issue them as fully automated financial products.

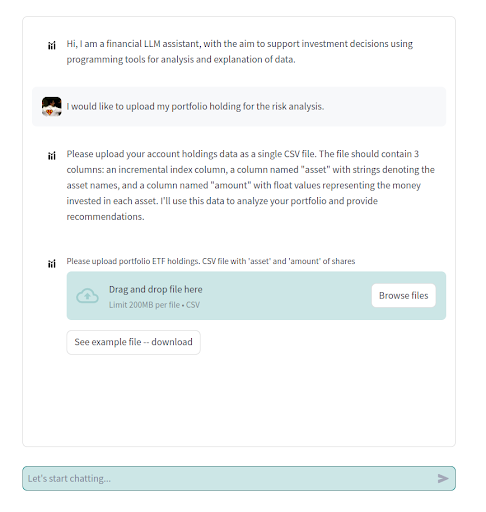

Our Large Language Models, developed on the open-source Llama 400B, simplify portfolio analysis through intuitive chat interfaces. These LLMs incorporate diverse risk models and portfolio optimization frameworks to enhance analysis efficiency and effectiveness. By integrating quantitative finance tools, they evaluate and manage risk exposure across multiple factors, using custom optimization solvers designed to align with client needs.

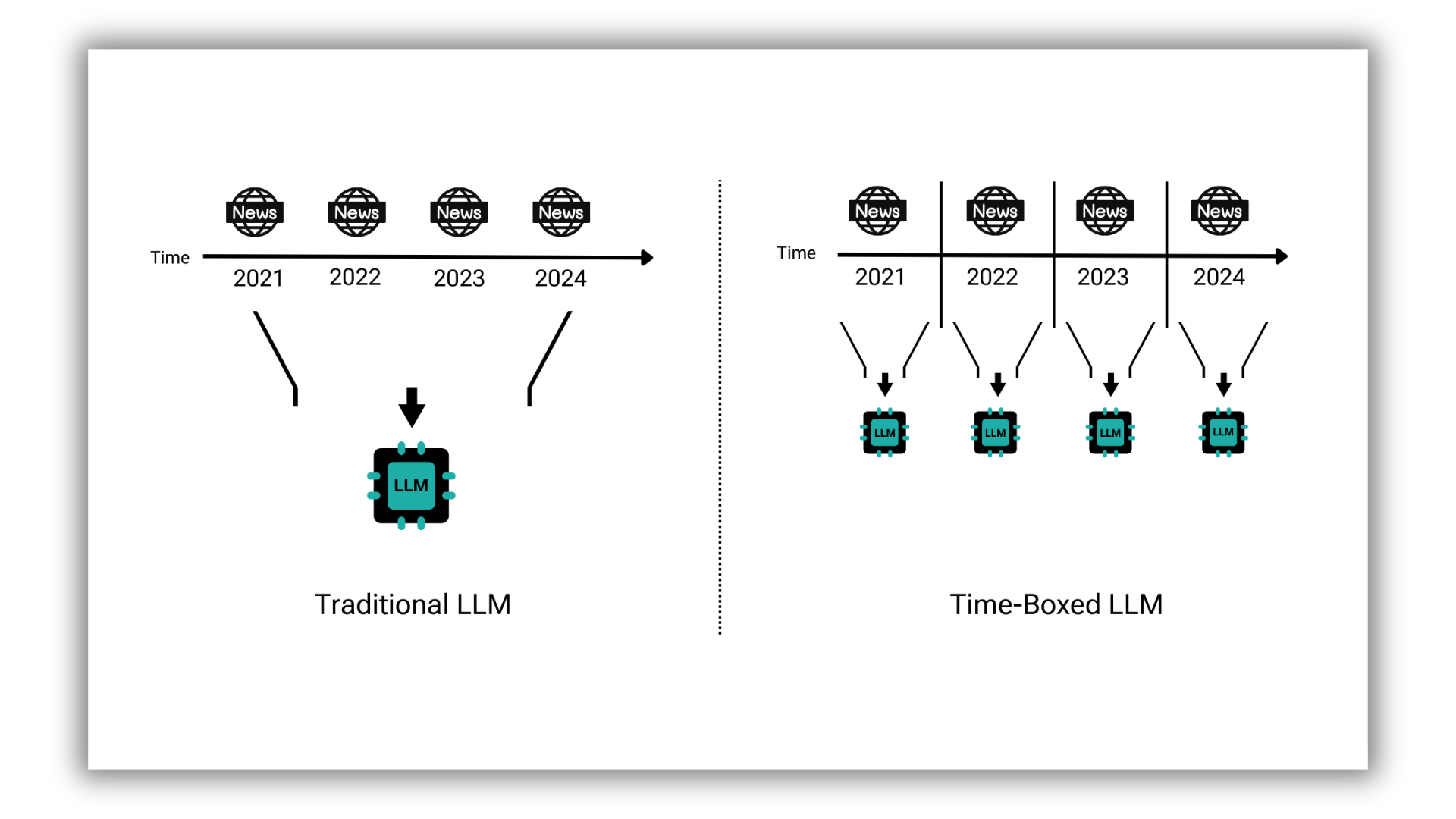

Clients can access this groundbreaking innovation on the AI Insights Platform or as a downloadable model for seamless integration into their machine learning workflows. It enhances investment strategies by tackling look-ahead bias with time-boxing, ensuring insights rely solely on data available at prediction time.

ZURICH / LONDON, 06.02.2026 — Aisot Technologies, the ETH Zurich spin-off specializing in AI-driven...

AI is reshaping how institutional investors work. At a World Economic Forum roundtable in Davos,...

2025 was an exciting and transformative year, marked by growth, new partnerships, continuous...