The investment manager's new edge: How AI took centre stage at FINANZ 2026

This year's financial fair FINANZ at the Kongresshaus Zurich left little doubt about where the...

The information in this website was prepared by Aisot Technologies AG for information and marketing purposes. However, Aisot Technologies makes no representation or warranty with respect to its contents or completeness and disclaims any liability for loss or damage of any kind incurred directly or indirectly through the use of this document or the information contained herein. All opinions expressed in this document are those of Aisot Technologies at the time of writing and are subject to change without prior notice. Unless otherwise stated, all figures are unaudited. This document is for the information of the recipient only and does not constitute investment advice, an offer or a recommendation to purchase financial instruments and does not release the recipient from his or her own evaluation and judgement. This document is explicitly not intended for persons whose nationality, place of residence or other characteristics prohibit access to such information due to applicable legislation.

Every investment involves risks, particularly those of fluctuations in value and income. Collective investments are volatile and an investment may result in the total loss of the capital invested. Furthermore, performance data does not account for the commissions and costs that may be charged on issue and/or redemption. Furthermore, it cannot be guaranteed that the performance of comparable indices will be achieved or exceeded. A positive performance in the past or the indication of such a performance is no guarantee for a positive performance in the future. Investments in foreign currencies may be subject to currency fluctuations. There is an additional risk that the foreign currency may lose value against the investor's reference currency.

The content provided by aisot is intended solely for natural personas and legal entities that are resident or have their registered office in Switzerland. More particularly, such content and functions are not intended for any person or entity who is subject to jurisdictions which prohibit to publish, supply or access information by aisot (e.g. due to the user's nationality or residence or on other grounds). Persons to whom these restrictions apply are not permitted to access information by aisot.

Traditional investment products often lack the flexibility and versatility needed by today’s sophisticated investors. This gap has led to the rise of innovative financial structures like the Swiss Actively Managed Certificate (AMC). An AMC, initially a Swedish innovation, allows for managing various assets within a single security. The Swiss AMC, issued by Swiss financial institutions, is gaining global traction for its enhanced asset management capabilities.

The core idea of an AMC is similar to that of an investment fund: pooling investor money for a specific objective. However, AMCs offer several distinct advantages:

Compared to Traditional Asset Management:

Compared to Funds:

To understand how AMCs work, here are the key steps:

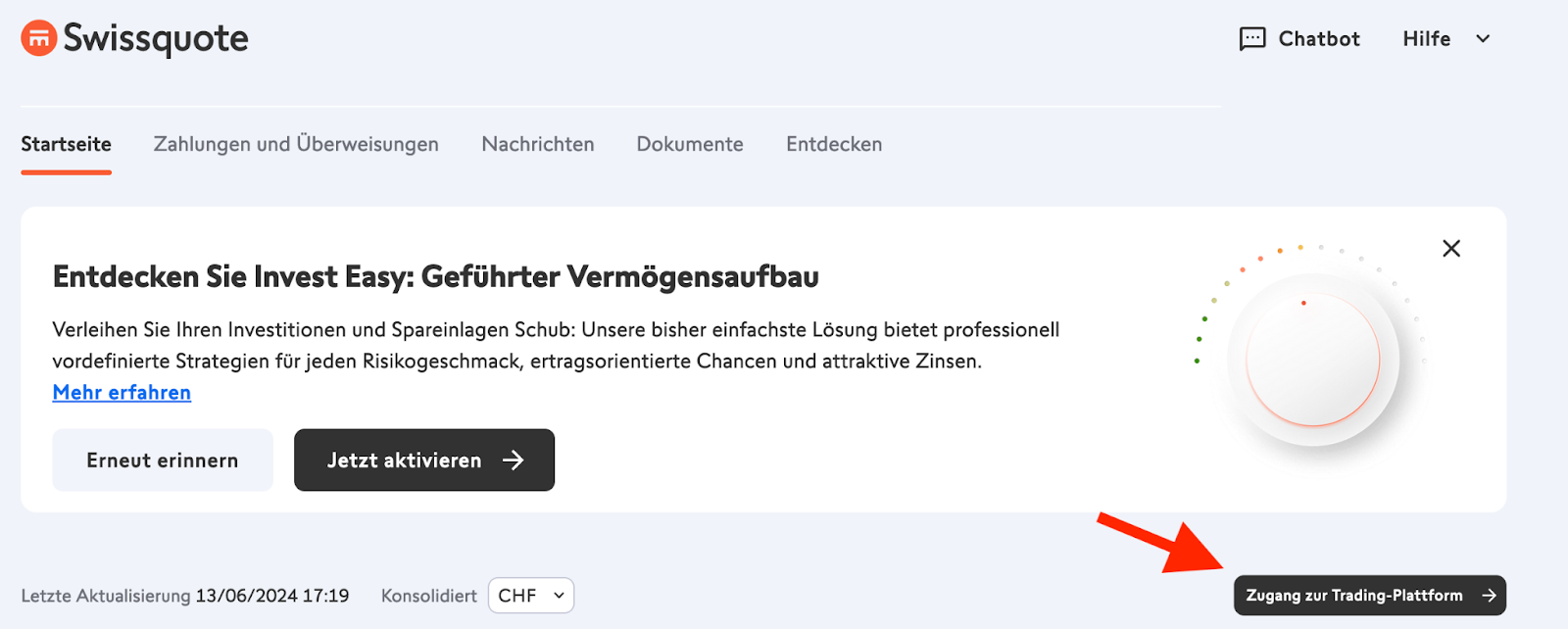

Access your e-banking platform using your login credentials. Make sure your account is secure and you are using a trusted device.

Once logged in, go to the “Markets & Trading” section of your e-banking portal.

Use the search function to find the specific AMC you wish to invest in. You can search by the AMC’s name, ticker symbol, or ISIN (International Securities Identification Number).

Choose the type of order you want to place (e.g., buy). Enter the amount you wish to invest and confirm the order.

Inform them that you wish to invest in an Actively Managed Certificate and provide the ISIN of the respective product.

Your Representative might ask for the respective Term Sheet of the product you are referring to. Download the Term Sheet (e.g. aisot AMC) and send it to the email they provide to you while staying in the call.

You might be able to buy the product directly over the phone while speaking with the Representative. Just tell them how many units you want to buy. There will be a small fee involved with the transaction.

If the Representative invites you to buy the product through your trading platform:

Proceed as you would be buying any other product. Remember to buy at market price to ensure execution on the cut off day (15th of each month).

This year's financial fair FINANZ at the Kongresshaus Zurich left little doubt about where the...

ZURICH / LONDON, 06.02.2026 — Aisot Technologies, the ETH Zurich spin-off specializing in AI-driven...

AI is reshaping how institutional investors work. At a World Economic Forum roundtable in Davos,...