Agentic AI Arrives on the Aisot Insights Platform

ZURICH / LONDON, 06.02.2026 — Aisot Technologies, the ETH Zurich spin-off specializing in AI-driven...

aisot's proprietary AI engine integrates various scientific systems and concepts such as financial time series forecasting, sentiment analysis, custom temporal mixture models and more.

aisot's artificial intelligence engine is built on the years of experience of our team in machine learning, deep learning, quant finance and natural language processing, empowering asset managers to generate alpha with customized investment strategies that adapt to clients' unique preferences across markets. Starting with market data (stocks, indices etc.), and expanding to alternative data (blogs, social media etc.) and macroeconomic data, the aisot AI engine combines millions of data points to extract better results from less but relevant data sources.

news articles screened

to train models

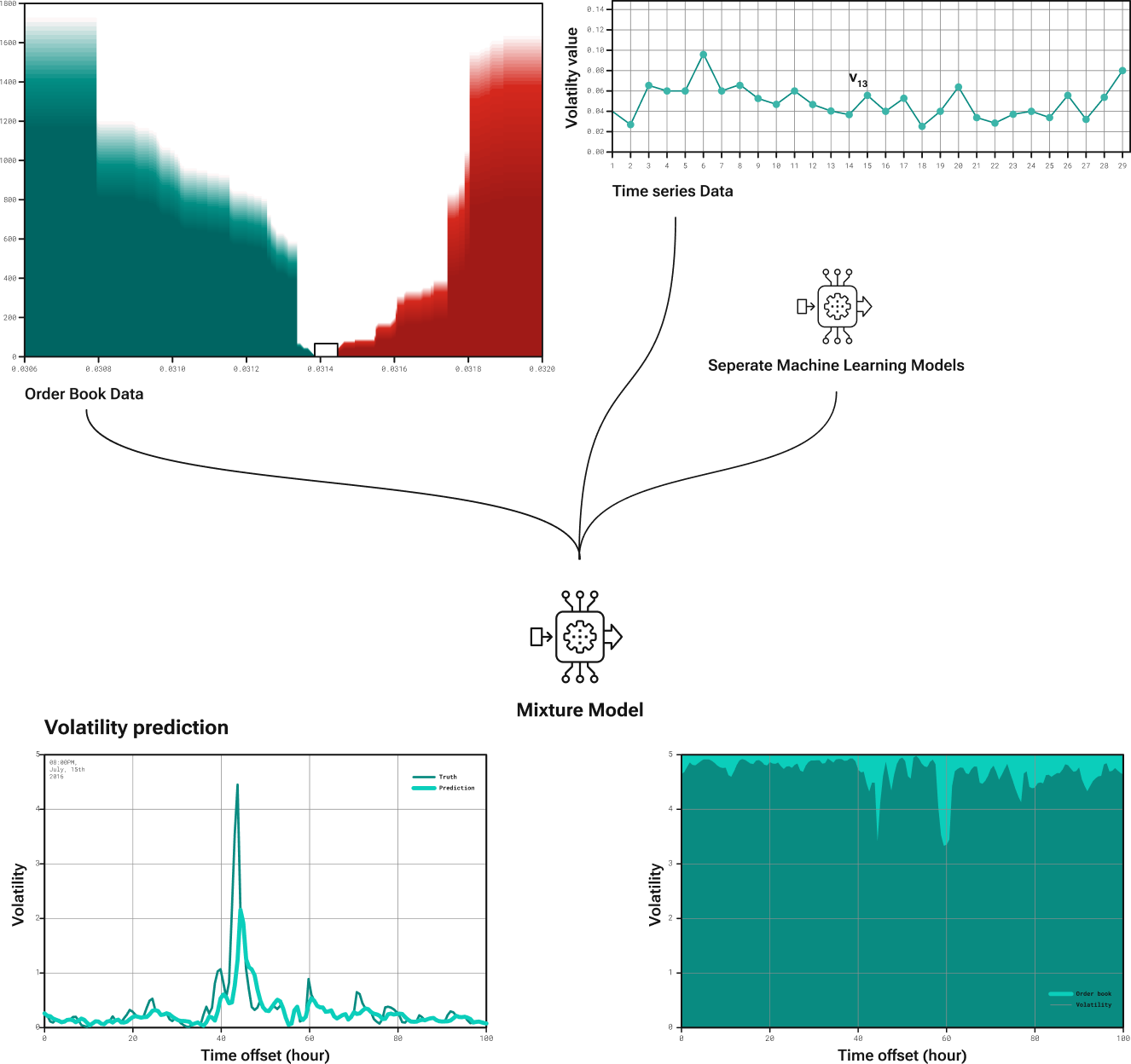

Up to 53% better forecasts of 1-hour realized volatility than the baseline

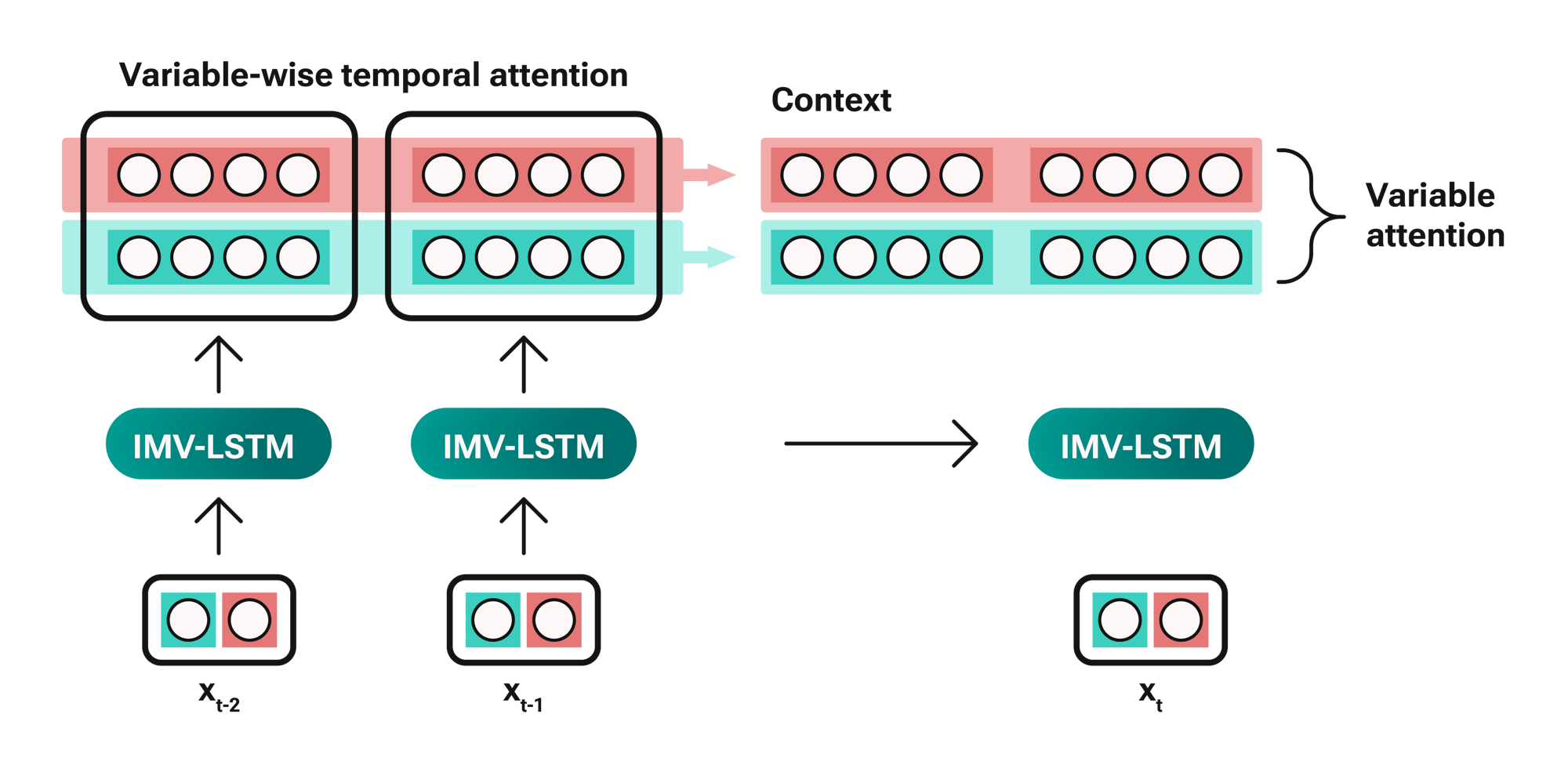

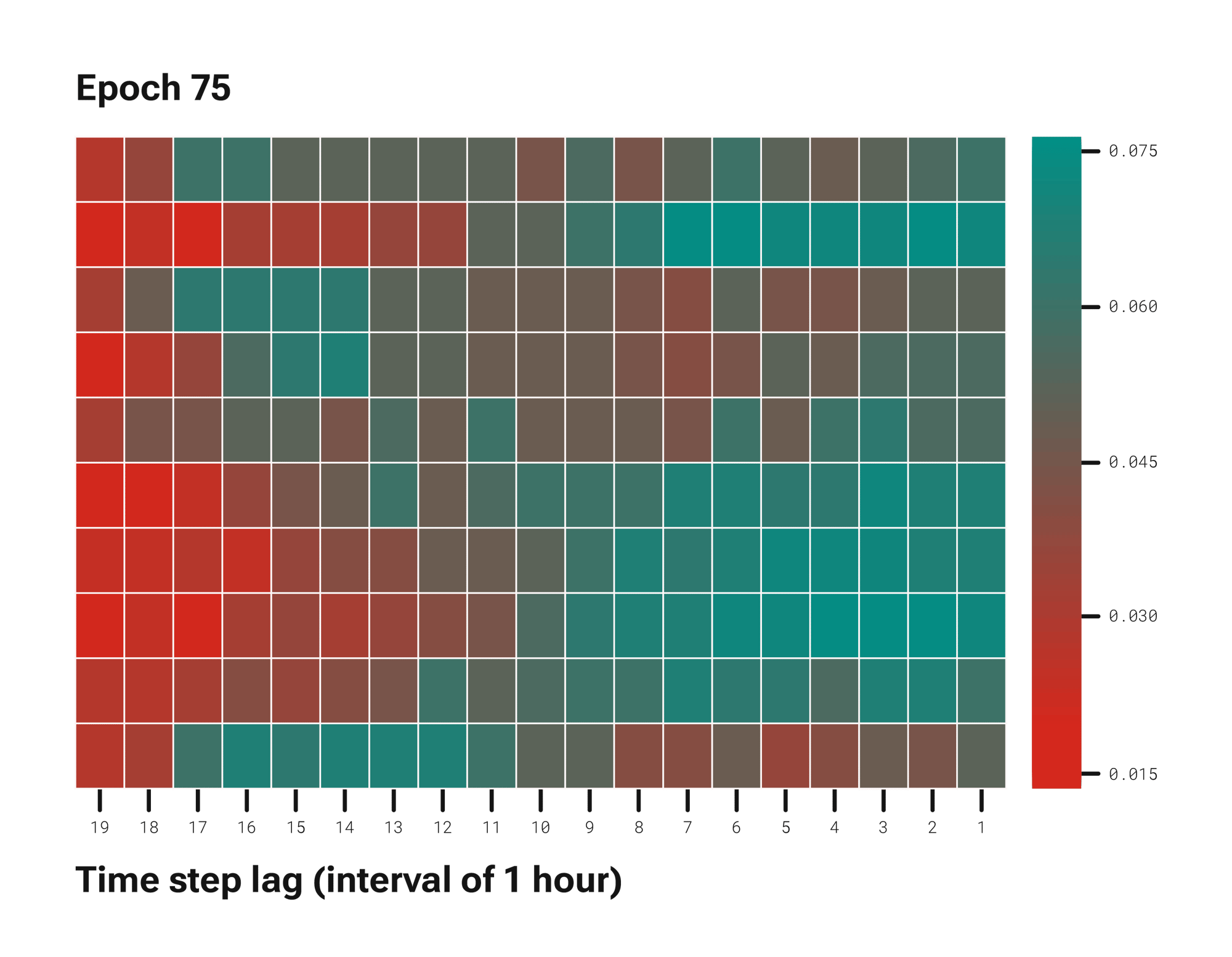

Interpretable multi-variable long short-term memory networks (IMV-LSTM) outperforms baselines by up to 80%

Financial time series forecasting is the process of predicting future values or trends of financial data over a period of time. It involves analyzing historical financial data and factors, such as stock prices, interest rates, or other financial indicators, and using statistical or machine learning techniques to make predictions about future values or trends in the data. aisot has developed proprietary AI technology (LSTM - long short-term memory networks) that can capture various patterns in time series data with multiple variables and determine the impact of each variable on the prediction. This approach allows for greater interpretability of the model's results.

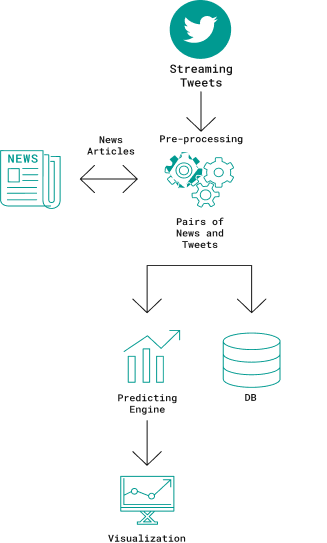

aisot analyzes a constant stream of news and social media data with different Natural Language Models, including Large Language Models. aisot quantifes the propagation and absorption of large-scale publicly available news articles from the Internet about financial markets.

Volatility, which measures the extent of price changes in financial markets, plays a crucial role in investment choices, strategies and systemic risk assessments. To improve the accuracy of volatility forecasting, aisot has developed a proprietary model called a custom temporal mixture model. This model intelligently utilizes both the historical patterns of volatility over time and the characteristics of the order book, which records buy and sell orders in the market. The order book provides valuable insights into market intentions and is closely connected to how volatility changes over time. By combining these factors, our model provides more precise predictions of future volatility.

ZURICH / LONDON, 06.02.2026 — Aisot Technologies, the ETH Zurich spin-off specializing in AI-driven...

AI is reshaping how institutional investors work. At a World Economic Forum roundtable in Davos,...