The investment manager's new edge: How AI took centre stage at FINANZ 2026

This year's financial fair FINANZ at the Kongresshaus Zurich left little doubt about where the...

Independent and external asset managers are navigating a challenging landscape marked by dwindling margins and competition from low-cost index funds. They are tasked with the dual mandate of ensuring cost-efficiency and delivering superior investment performance. Balancing the need for market-comparable risk-adjusted returns with a distinct investment style adds to the complexity. Clients expect top-notch service, bespoke portfolios that perform, and competitive pricing. Reporting obligations and volatile market conditions add layers of difficulty to their strategic planning.

Traditionally, tailoring investment portfolios to individual customer needs—covering their specific investment scope, goals, and constraints—has been a costly endeavor, with high research and reporting expenses making it difficult to offer personalized services to affluent and retail clients. Portfolio managers also struggled to add unique value for large institutional clients beyond niche areas.

However, the introduction of automated data analysis and modern Machine Learning (ML) technology is changing this dynamic. These innovations allow for the integration of customer preferences at minimal extra cost, with automated systems efficiently generating optimal portfolios. This enables asset managers to keep their distinct investment strategies while leveraging technology to streamline processes and stand out in the market by offering scalable, customized investment solutions.

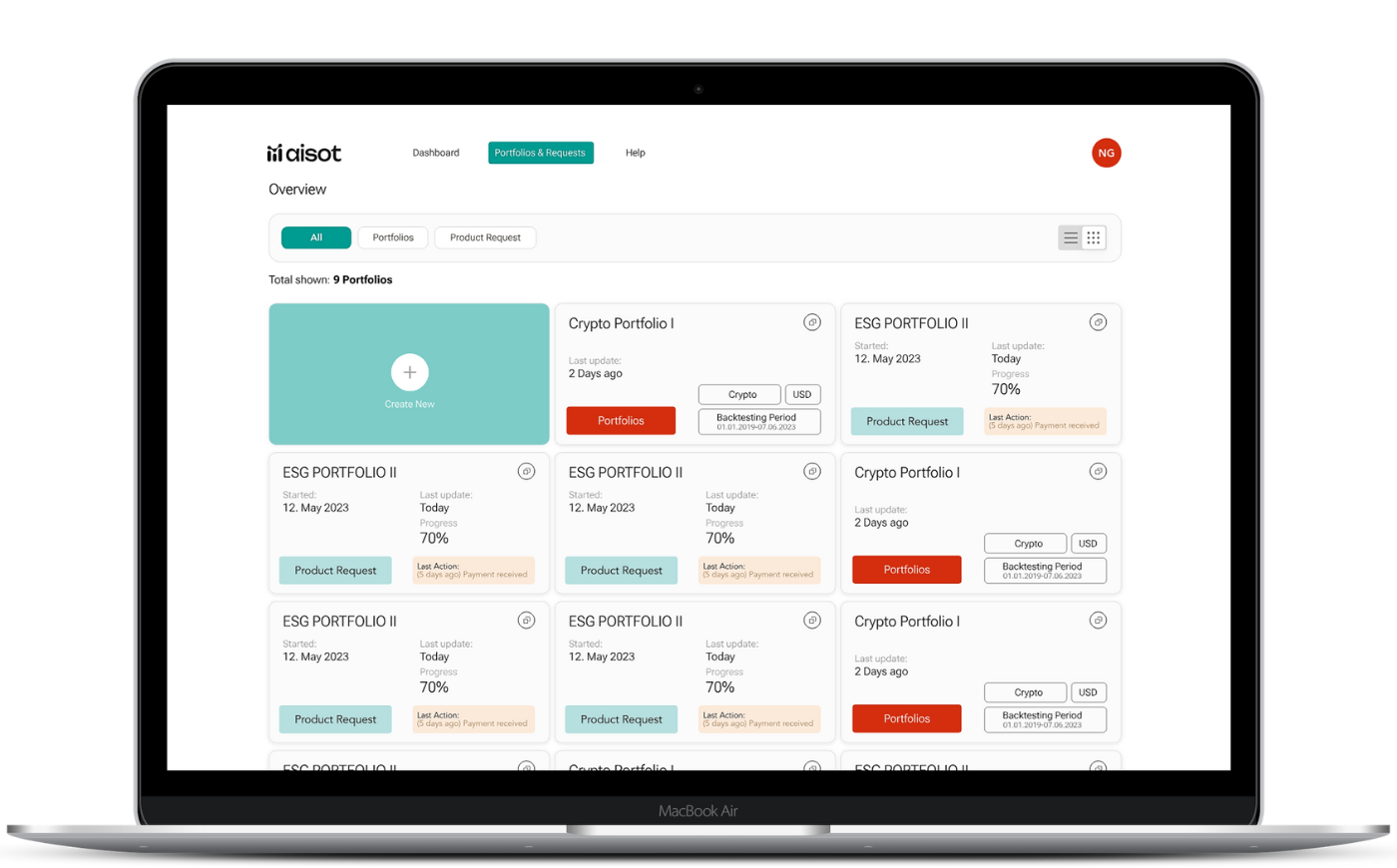

Portfolio overview section of the AI Insights Platform

Volatility target and instrument selection view on the AI Insights Platform.

Aisot Technologies provides asset managers with an advanced platform for crafting high-performance, tailored investment strategies. Leveraging our aisot AI Insights Platform, users can optimize portfolios across diverse markets using cutting-edge AI. This platform offers rapid prototyping for Machine Learning and quant strategies, including in-depth backtesting, streamlining the strategy creation process, and cutting research costs. Asset managers can achieve exceptional results, even within limited investment scopes or under strict constraints. With clear explanations of security selections and analytics for new opportunities, plus our Product Launchpad for custom financial products, Aisot simplifies portfolio management.

Subscribing to the platform grants users access to the following features:

This year's financial fair FINANZ at the Kongresshaus Zurich left little doubt about where the...

ZURICH / LONDON, 06.02.2026 — Aisot Technologies, the ETH Zurich spin-off specializing in AI-driven...

AI is reshaping how institutional investors work. At a World Economic Forum roundtable in Davos,...