Agentic AI Arrives on the Aisot Insights Platform

ZURICH / LONDON, 06.02.2026 — Aisot Technologies, the ETH Zurich spin-off specializing in AI-driven...

The information in this website was prepared by Aisot Technologies AG for information and marketing purposes. However, Aisot Technologies makes no representation or warranty with respect to its contents or completeness and disclaims any liability for loss or damage of any kind incurred directly or indirectly through the use of this document or the information contained herein. All opinions expressed in this document are those of Aisot Technologies at the time of writing and are subject to change without prior notice. Unless otherwise stated, all figures are unaudited. This document is for the information of the recipient only and does not constitute investment advice, an offer or a recommendation to purchase financial instruments and does not release the recipient from his or her own evaluation and judgement. This document is explicitly not intended for persons whose nationality, place of residence or other characteristics prohibit access to such information due to applicable legislation.

Every investment involves risks, particularly those of fluctuations in value and income. Collective investments are volatile and an investment may result in the total loss of the capital invested. Furthermore, performance data does not account for the commissions and costs that may be charged on issue and/or redemption. Furthermore, it cannot be guaranteed that the performance of comparable indices will be achieved or exceeded. A positive performance in the past or the indication of such a performance is no guarantee for a positive performance in the future. Investments in foreign currencies may be subject to currency fluctuations. There is an additional risk that the foreign currency may lose value against the investor's reference currency.

The content provided by aisot is intended solely for natural personas and legal entities that are resident or have their registered office in Switzerland. More particularly, such content and functions are not intended for any person or entity who is subject to jurisdictions which prohibit to publish, supply or access information by aisot (e.g. due to the user's nationality or residence or on other grounds). Persons to whom these restrictions apply are not permitted to access information by aisot.

In today's dynamic and unpredictable investment environment, institutional and professional investors encounter significant challenges. The pursuit of consistent returns, effective risk management, and adept market navigation demands not only expertise but also advanced tools. In response to these complexities, aisot introduces the "Best of SMI" portfolio, offering an AI-powered approach to achieving financial success. This cutting-edge investment instrument is designed to meet the sophisticated needs of professional investors, utilizing state-of-the-art AI technologies to redefine portfolio management.

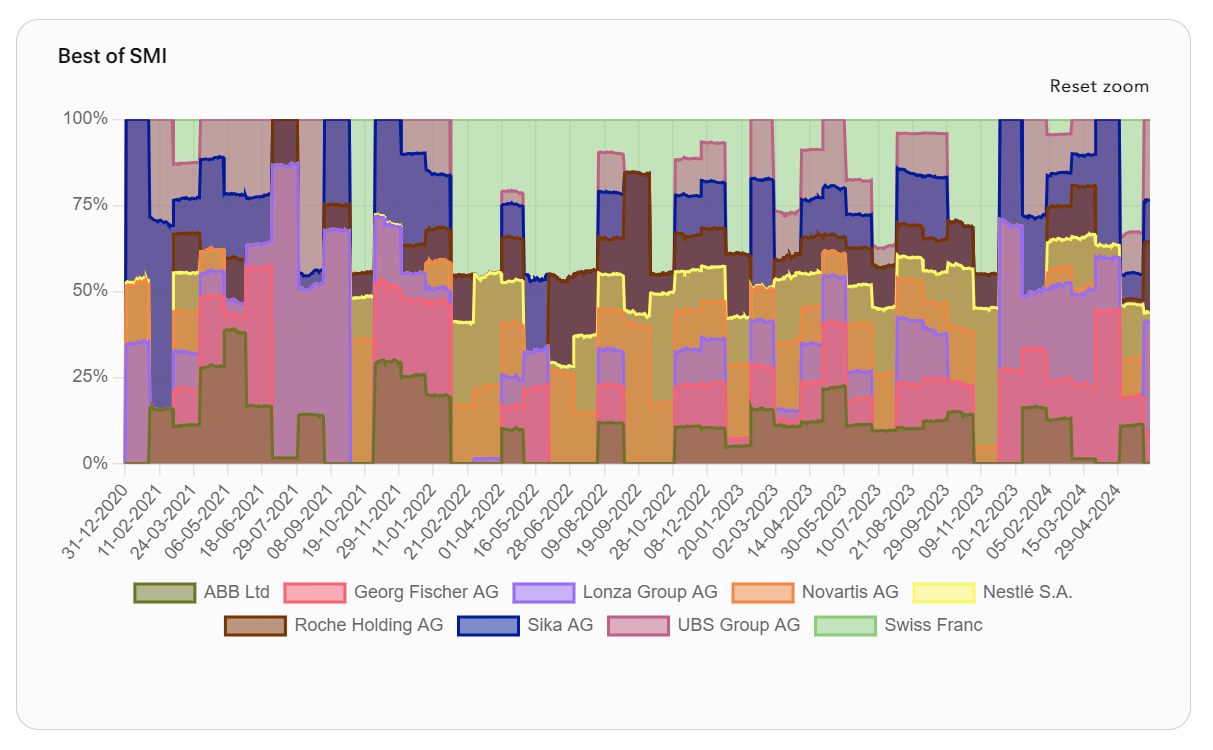

The portfolio "Best of SMI" represents key segments of the Swiss market and stands for innovation. It can include the stocks of ABB, Georg Fischer, Sika, Roche, Lonza, Nestlé, Novartis, and UBS. These companies are selected for their strong market presence, innovation leadership, and robust financial health, making them ideal candidates for long-term growth and stability. By leveraging machine learning, quantitative techniques, the strategy's portfolio weights are dynamically optimized and rebalanced monthly. The portfolio incorporates up to a 45% cash component to manage drawdowns.

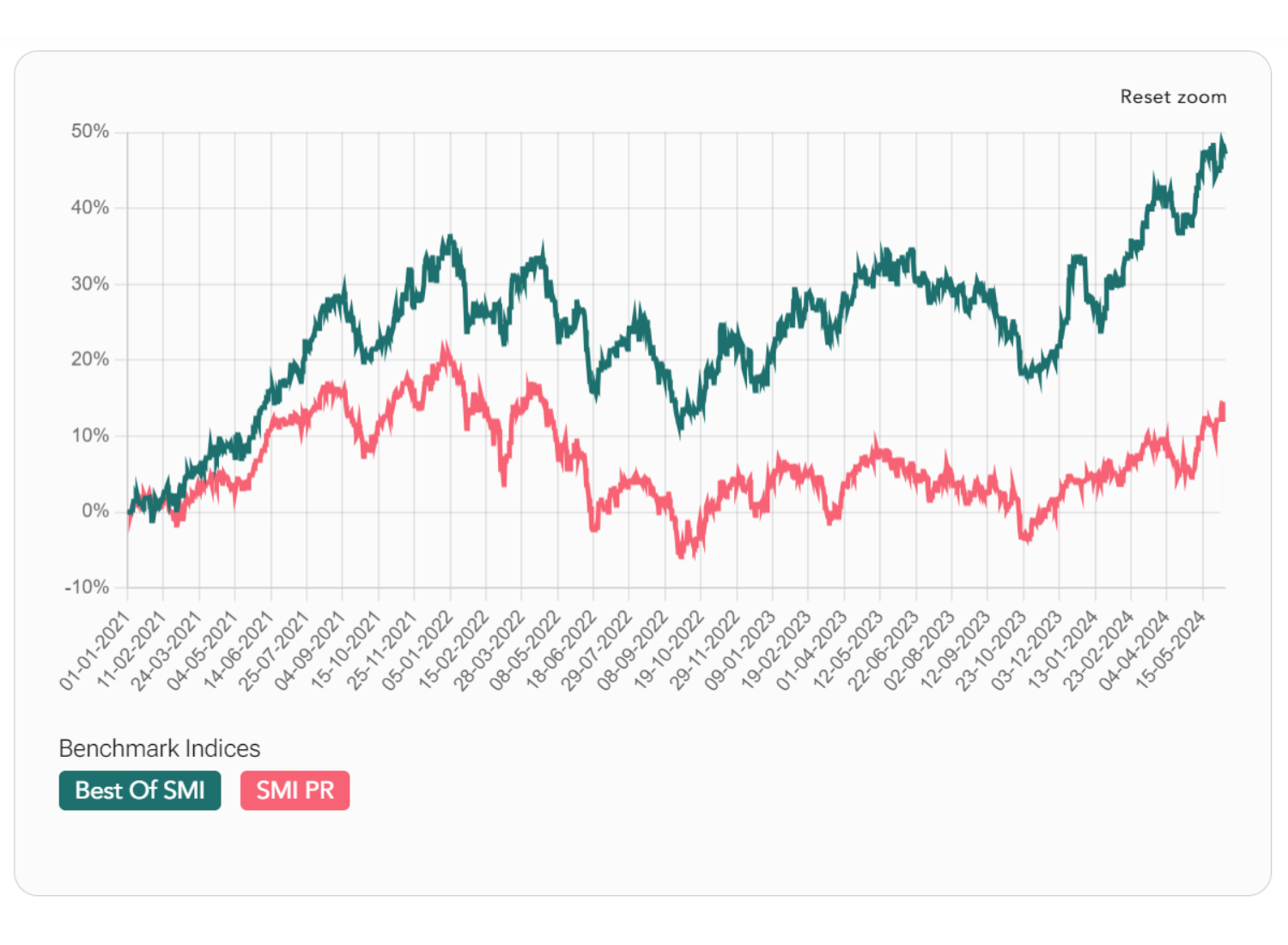

From January 1, 2021, to June 10, 2024, the AI-optimized portfolio "Best of SMI" achieved an annualized performance of 11.86%, compared to the SMI's annualized 4.01% performance. The AI-optimized portfolio has an annualized volatility of 13.48%, which is more or less the same as the SMI (12.78%).

01 January 2021 - Monday, 10 June 2024, back-tested results, net of trading fees

| Best of SMI | SMI | |

| Sharpe Ratio A | 0.8991 | 0.3717 |

| Sortino Ratio A | 1.2844 | 0.5237 |

| Max Drawdown | -0.1867 | -0.2234 |

| Annualized Volatility | 0.1348 | 0.1278 |

| Annualized Return | 0.1186 | 0.0401 |

Historic portfolio composition: 01 January 2021 - Monday, 10 June 2024

Agile & responsive: Utilizing machine learning, quantitative techniques, and the latest LLM sentiment analysis, the certificate's portfolio weights are dynamically optimized. A monthly rebalancing mechanism ensures agility and responsiveness to market shifts, maintaining optimal performance.

Companies are chosen based on their significant influence and leadership in their respective sectors, ensuring a robust and stable investment foundation.

The portfolio targets companies known for their innovative approaches and consistent investment in research and development, positioning them for sustained growth.

Stocks are selected based on strong financial performance, solid balance sheets, and reliable earnings, providing a cushion against market volatility.

By including a mix of industries such as healthcare, consumer goods, and industrials, the portfolio achieves a balanced exposure, reducing sector-specific risks.

ZURICH / LONDON, 06.02.2026 — Aisot Technologies, the ETH Zurich spin-off specializing in AI-driven...

AI is reshaping how institutional investors work. At a World Economic Forum roundtable in Davos,...

2025 was an exciting and transformative year, marked by growth, new partnerships, continuous...