Agentic AI Arrives on the Aisot Insights Platform

ZURICH / LONDON, 06.02.2026 — Aisot Technologies, the ETH Zurich spin-off specializing in AI-driven...

Since the 1950s, stock market volatility has steadily risen, reinforcing the view that volatility is a permanent market feature. Although not inherently negative, it's essential to shield portfolios from substantial losses. Regardless of their risk tolerance, market players, especially company treasuries, aim to protect asset values. The universal goal across various investment styles and asset classes is to reduce downside risk, akin to riding the market's highs and dodging financial downturns.

Traditionally, portfolio risk management has focused on metrics such as volatility, Value at Risk, and factor models. However, the advent of automated data analysis and Machine Learning is transforming these practices. Aisot enhances traditional risk assessment by incorporating market and alternative data, along with cutting-edge Machine Learning forecasts and advanced covariance estimators, offering a more comprehensive approach to managing portfolio risk.

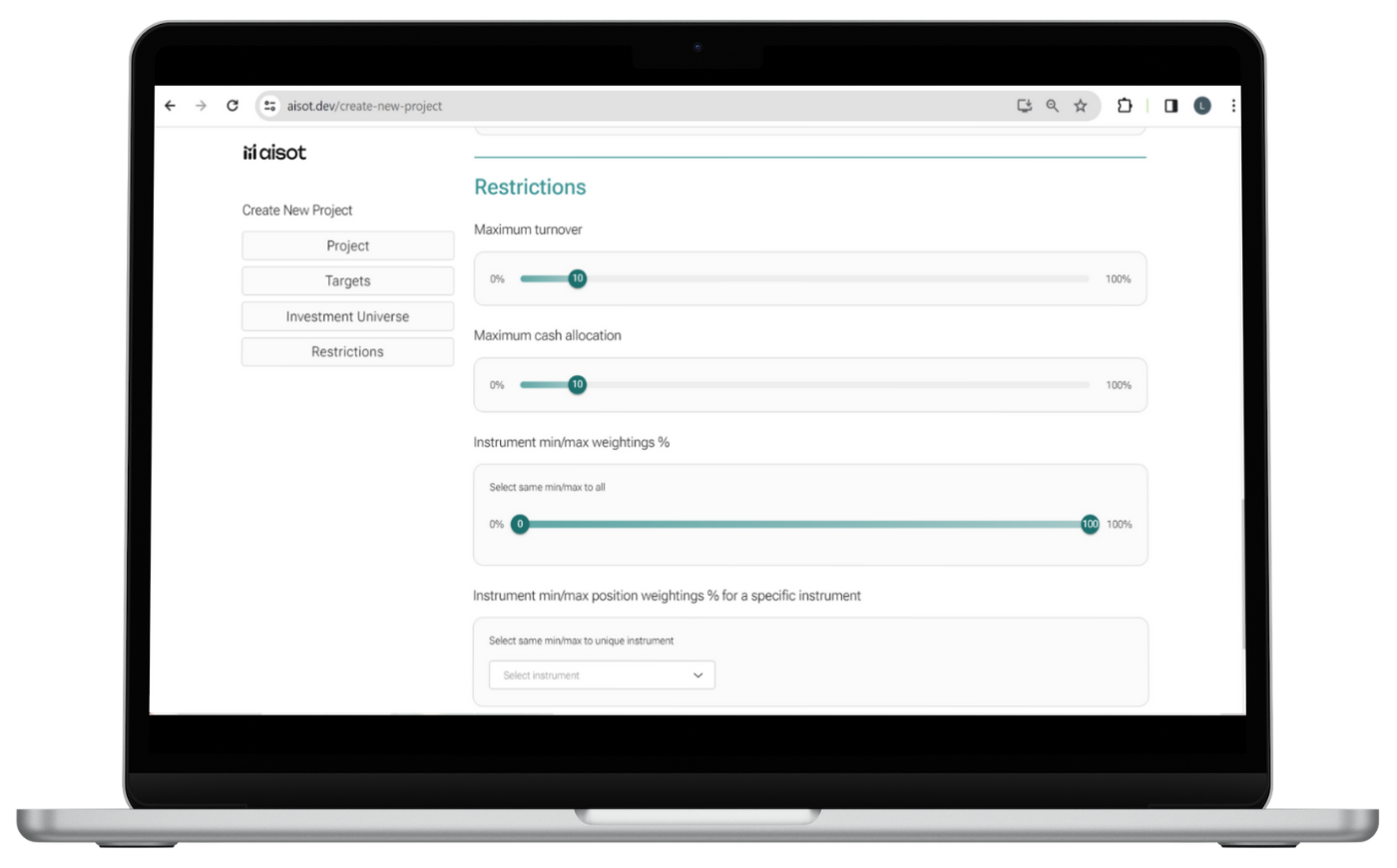

Restrictions selection on the AI Insights Platform.

Performance & portfolio composition view on the AI Insights Platform.

Aisot Technologies offers Treasuries a cutting-edge platform for crafting tailored investment strategies with a focus on downside protection. Utilizing advanced AI, the aisot AI Insights Platform enables the efficient creation and optimization of portfolios across various markets. It provides comprehensive tools for portfolio construction, risk management, and backtesting, streamlining strategy development and reducing research costs. This empowers clients to excel in constrained investment spaces. The platform also delivers clear insights on security selection and access to new investment opportunities, along with a Product Launchpad for creating custom financial products efficiently. Additionally, aisot offers portfolio management delegation, providing a full suite of services for managing secure portfolios.

Subscribing to the platform grants users access to the following features:

ZURICH / LONDON, 06.02.2026 — Aisot Technologies, the ETH Zurich spin-off specializing in AI-driven...

AI is reshaping how institutional investors work. At a World Economic Forum roundtable in Davos,...

2025 was an exciting and transformative year, marked by growth, new partnerships, continuous...