The investment manager's new edge: How AI took centre stage at FINANZ 2026

This year's financial fair FINANZ at the Kongresshaus Zurich left little doubt about where the...

Brokers and Portfolio Management Software (PMS) systems worldwide are grappling with increased competition, leading to reduced fees and tighter margins. A key issue is that many traders, both retail and professional, often lose money, with evidence suggesting less frequent rebalancing might be more beneficial. However, brokerage and PMS providers benefit from more frequent trading by profitable customers. Clients now seek exceptional service, competitive pricing, and insights that can enhance their trading performance.

Traditionally focused on liquidity, spreads, and fees, brokerage and PMS providers now leverage automated analysis and Machine Learning to offer advanced analytics and real-time insights. These technologies enable users to access detailed signals for optimized portfolio management, risk and return forecasts, and market timing. Integrating personal strategies with these automated systems enhances trading outcomes, encouraging more frequent trades and increased account balances, ultimately boosting provider revenues.

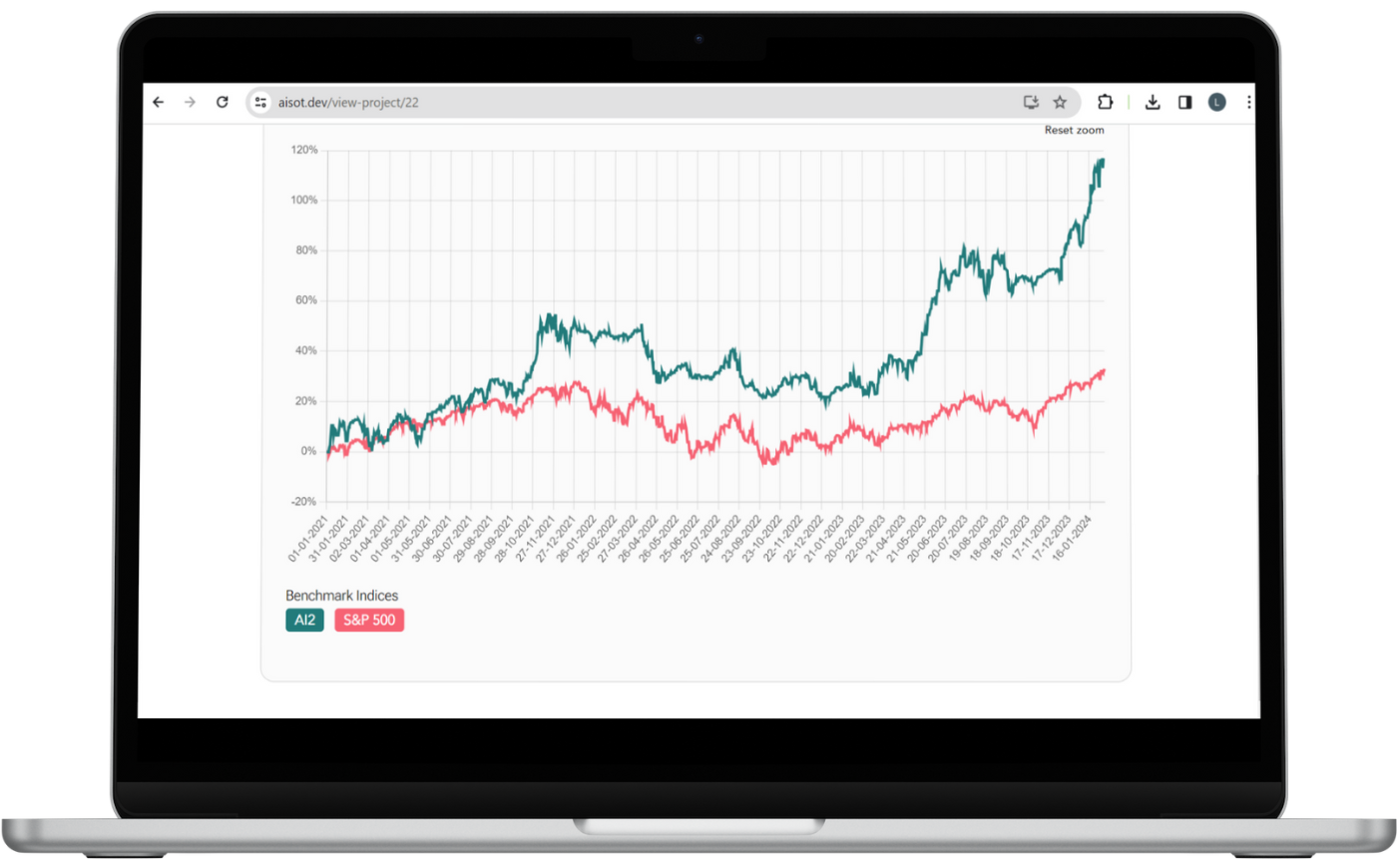

Performance view on the AI Insights Platform.

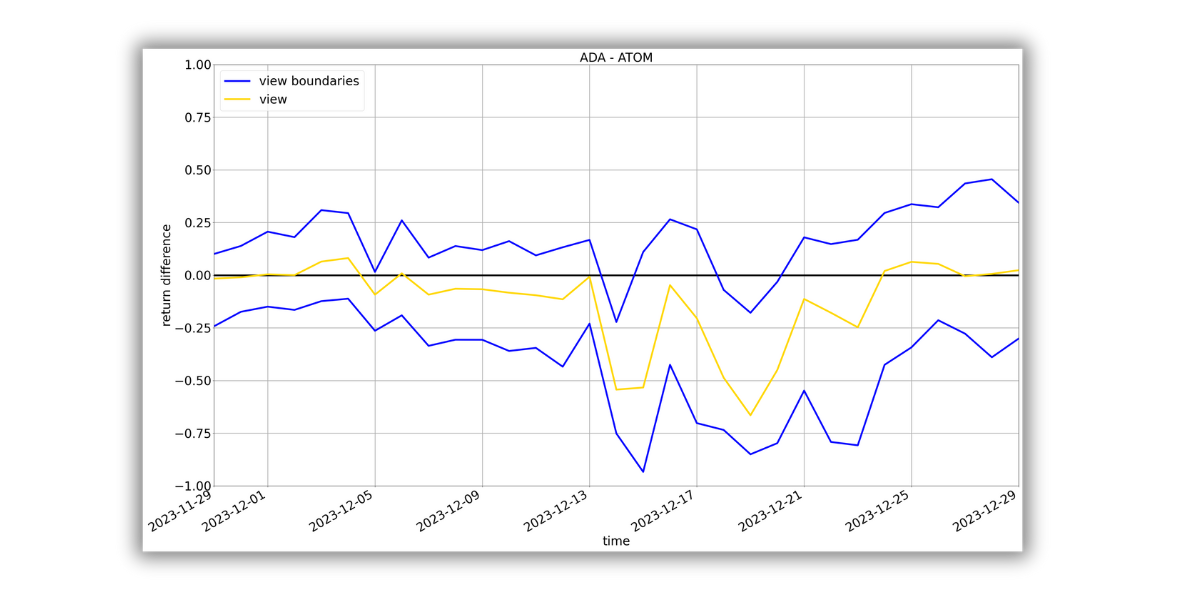

Graphical representation of pairwise return curve forecast over a one month period.

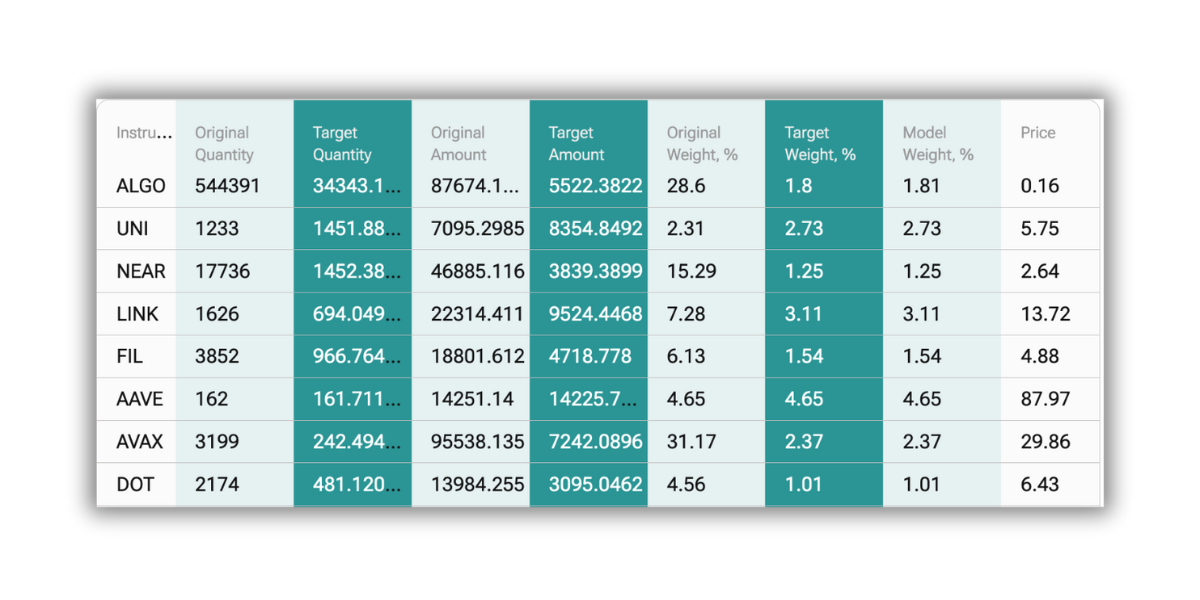

Real-time rebalancing insights on portfolio level.

Aisot Technologies boosts broker and PMS provider revenues by driving user engagement with our AI-powered platform. Leveraging advanced AI through our API, we optimize trading and portfolio management across diverse markets. Our insights draw from extensive data, including market trends, sentiment, risks, and price movements, offering both analytical and predictive perspectives. Features include model portfolio insights and rebalancing trades, plus tools to uncover new investment opportunities. Brokers and PMS providers can explore a comprehensive suite of insights available through the aisot AI Insights Platform by scheduling an initial call.

This year's financial fair FINANZ at the Kongresshaus Zurich left little doubt about where the...

ZURICH / LONDON, 06.02.2026 — Aisot Technologies, the ETH Zurich spin-off specializing in AI-driven...

AI is reshaping how institutional investors work. At a World Economic Forum roundtable in Davos,...