Product Update: AI Insights Platform Version 2.0 for Digital Assets

aisot is set to unveil the second version of the AI Insights Platform for Digital Assets, representing a significant leap forward in terms of usability and functionality. The update introduces a more intuitive user experience, enhancing overall usability. A central overview page consolidates all created strategies and live products, providing users with an improved and streamlined interface.

A highlight in this release is the introduction of the rebalancer, empowering users to seamlessly readjust their portfolios in line with the optimized model portfolios generated on the AI Insights Platform. Our rebalancer employs a proprietary methodology, delivering the most accurate trading insights tailored to each client's specific cost structures. This ensures our clients achieve full alignment with their investment strategy.

The context for this update lies in aisot's commitment to shaping the future of asset management through cutting-edge AI technology. The AI Insights Platform has already marked a pivotal milestone with its inaugural clients, offering fully AI-driven investment products and optimized portfolios for digital assets.

Let’s have a closer look at selected features of the AI Insights Platform.

Creating an investment strategy with the AI Insights Platform

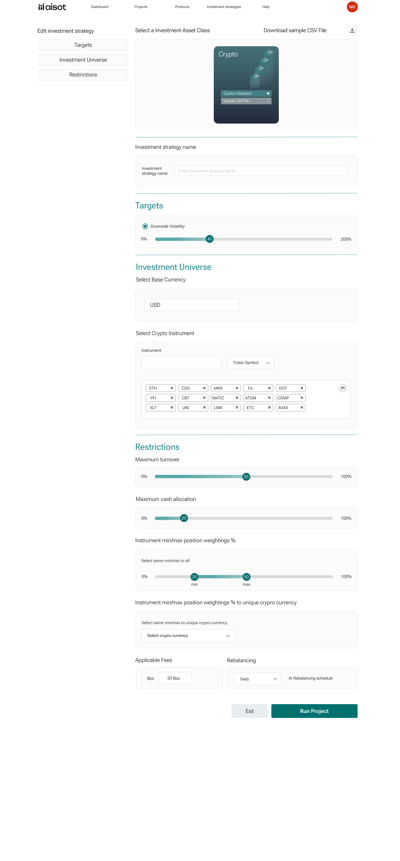

The new release of the AI Insights Platform comes with a dedicated space to design, validate and customize strategies. This is where users can develop strategies that differ in terms of volatility profile, portfolio composition, restrictions and other factors and adjust backtesting as well as rebalancing periods.

Constructing new portfolios of digital assets or adjusting existing ones is a straightforward process. Starting with the selection of the backtesting period, target volatility (annualized) and the choice of the base currency along with the client's investable coin universe, the process proceeds to fine-tune parameters such as maximum turnover (ranging from 0% to 100%), maximum cash allocation (ranging from 0% to 100%), and customizable weightings (in percentage) for either all assets or specific ones. The final steps encompass incorporating applicable fees and determining the preferred rebalancing frequency (daily, weekly, or monthly), thereby completing the configuration process.

(Platform screenshots for explanation purposes only. Selection of assets and customization is not investment advice)

Launching new products

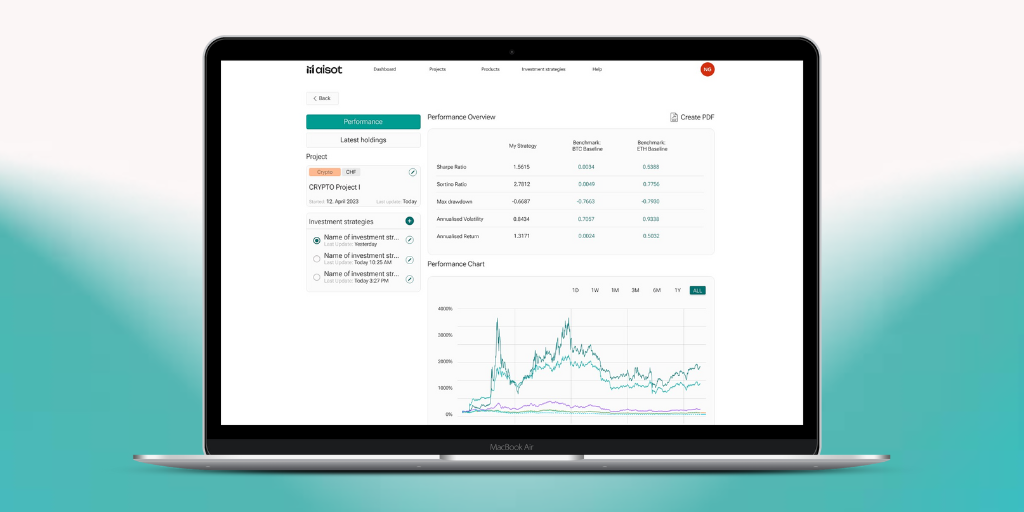

Initiate the process by conducting a comprehensive backtest of the strategy, allowing for a thorough review of key figures and plots. Upon achieving satisfaction with the investment strategy, the subsequent steps in the productization process unfold seamlessly.

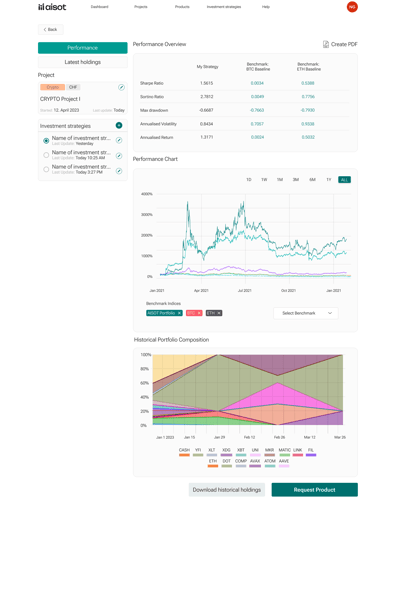

Once the portfolio is generated, a comprehensive performance overview is presented, including Sharpe and Sortino ratios, maximum drawdown, annualized volatility, and annualized returns. Additionally, performance charts for the selected backtesting period and graphical representations of the historical portfolio composition are generated.

By selecting “Request Product”, the Product Launch Pad can be accessed. It offers the unique capability to launch structured notes, providing a seamless and efficient way to transform investment strategies into liquid and tradable securities. Currently products can be requested as Actively Managed Certificates (AMC), Exchange-traded product (ETP), exchange-traded fund (ETF), and as a Fund. The platform allows regulated clients to rebalance strategies at their discretion, providing flexibility and control over the investment process.

By selecting “Request Product”, the Product Launch Pad can be accessed. It offers the unique capability to launch structured notes, providing a seamless and efficient way to transform investment strategies into liquid and tradable securities. Currently products can be requested as Actively Managed Certificates (AMC), Exchange-traded product (ETP), exchange-traded fund (ETF), and as a Fund. The platform allows regulated clients to rebalance strategies at their discretion, providing flexibility and control over the investment process.

(Platform screenshots for explanation purposes only. Selection of assets and customization is not investment advice)

.png?width=352&name=Jul%202021%20(43).png)