Five Predictions for AI in Asset Management in 2024

Artificial intelligence (AI) is revolutionizing industries such as finance and asset management. As 2024 approaches, we expect AI's role in asset management to grow significantly. Here are five key predictions for AI's impact on investment in the coming year.

.png?width=1099&height=550&name=Jul%202021%20(43).png)

- Enhanced Portfolio Optimization:

AI will see broader adoption in portfolio optimization and construction. Moving beyond traditional value-based stock selection and mean-variance optimization, asset managers will increasingly integrate AI and machine learning for more sophisticated portfolio modeling. This approach allows for robust optimization considering non-linear dynamics, deep learning for price trend analysis, sentiment analysis, and natural language processing of financial news. Portfolios constructed using AI in 2024 could demonstrate lower drawdowns and improved risk-optimized performance, even in challenging scenarios like targeting low volatility with small portfolio sizes. - AI-Powered Investor Dashboards:

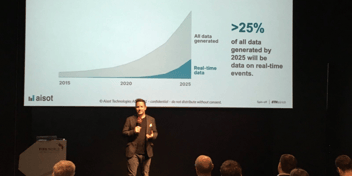

In 2024, investors will benefit from advanced, AI-driven dashboards offering real-time portfolio tracking, insights, risk assessment, and decision-making support. These dashboards may offer personalized recommendations on asset allocation, risk management, and ESG criteria, enhancing investor analytics and reporting capabilities. - Utilization of Alternative Data Sets:

AI will increasingly analyze expansive and diverse data sets, including satellite imagery, e-receipts, social media feeds, and online search trends, to inform investment decisions. Combined with traditional financial statements, these alternative data sources can offer asset managers a competitive edge in stock selection and trade execution. Natural language processing will be key in extracting insights from earnings calls, IPO prospectuses, and 10-K reports. - Investment Workflow Automation:

AI's adoption in asset management will expand to automate routine tasks in the investment process, such as data collection, data quality checks, and report generation. This automation allows analysts and portfolio managers to concentrate on high-value activities that require human expertise and supervision. Risk analytics and regulatory compliance will also see efficiency gains through automation. - Personalized AI Advice and Insights:

AI platforms will deliver customized insights, research, advice, and recommendations, tailored to investors' preferences, financial circumstances, life stages, and goals. Integrating generative AI functions, these systems will be capable of interpreting questions, inferring intent, and engaging in meaningful dialogue. Over time, AI could become a valuable supplement to financial advisors, enhancing their capacity and reach.

In summary, AI is set to significantly transform asset management in the coming years. With its advancements, AI will influence aspects from portfolio construction to the investor experience. While human oversight remains vital, AI will bolster data-driven decision-making, reveal hidden insights, streamline manual processes, and offer personalized financial advice on demand. Asset management firms that strategically embrace AI could gain a substantial competitive edge in 2024 and beyond.