Agentic AI Arrives on the Aisot Insights Platform

ZURICH / LONDON, 06.02.2026 — Aisot Technologies, the ETH Zurich spin-off specializing in AI-driven...

The information in this website was prepared by Aisot Technologies AG for information and marketing purposes. However, Aisot Technologies makes no representation or warranty with respect to its contents or completeness and disclaims any liability for loss or damage of any kind incurred directly or indirectly through the use of this document or the information contained herein. All opinions expressed in this document are those of Aisot Technologies at the time of writing and are subject to change without prior notice. Unless otherwise stated, all figures are unaudited. This document is for the information of the recipient only and does not constitute investment advice, an offer or a recommendation to purchase financial instruments and does not release the recipient from his or her own evaluation and judgement. This document is explicitly not intended for persons whose nationality, place of residence or other characteristics prohibit access to such information due to applicable legislation.

Every investment involves risks, particularly those of fluctuations in value and income. Collective investments are volatile and an investment may result in the total loss of the capital invested. Furthermore, performance data does not account for the commissions and costs that may be charged on issue and/or redemption. Furthermore, it cannot be guaranteed that the performance of comparable indices will be achieved or exceeded. A positive performance in the past or the indication of such a performance is no guarantee for a positive performance in the future. Investments in foreign currencies may be subject to currency fluctuations. There is an additional risk that the foreign currency may lose value against the investor's reference currency.

The content provided by aisot is intended solely for natural personas and legal entities that are resident or have their registered office in Switzerland. More particularly, such content and functions are not intended for any person or entity who is subject to jurisdictions which prohibit to publish, supply or access information by aisot (e.g. due to the user's nationality or residence or on other grounds). Persons to whom these restrictions apply are not permitted to access information by aisot.

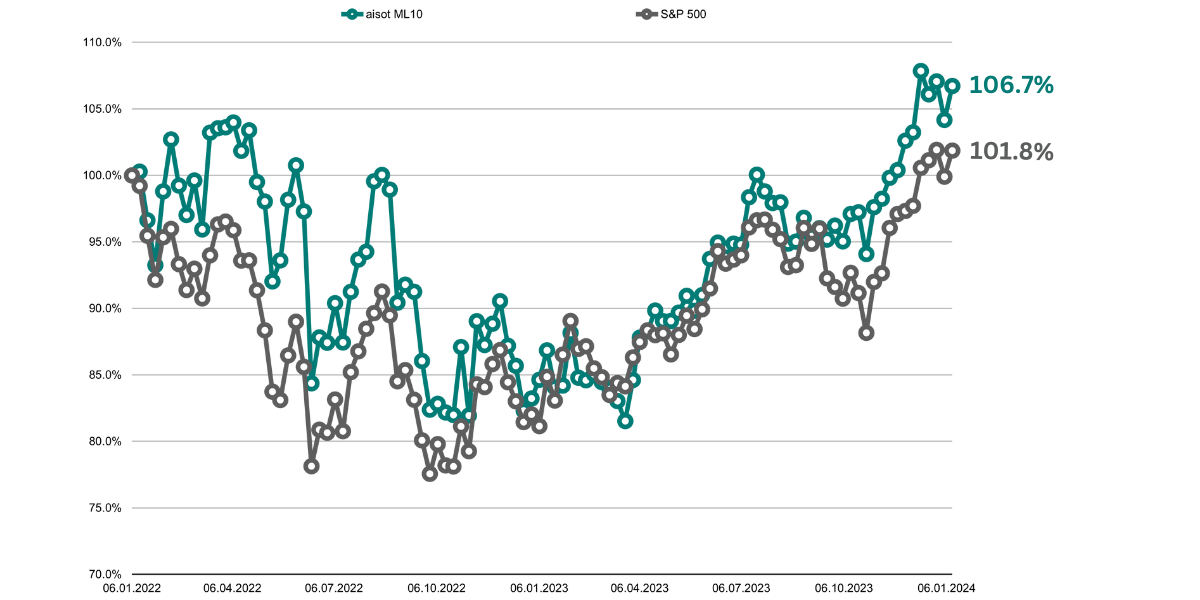

The aisot ML S&P 500 strategy aims to provide investors with long-term capital appreciation by utilizing a proprietary artificial intelligence (AI) system to create a portfolio which focuses on short-term momentum, volatility control and diversification of companies in the S&P 500 index.

aisot uses machine learning algorithms and historical and real-time data to identify relevant features and patterns in stock price movements, enabling it to make short-term momentum forecasts and construct portfolios of securities with the highest predicted momentum.

Volatility overlay

Variance optimization is performed over the subset of top ranked titles from AI Insights platform to produce equal dollar amount allocation for 10 titles, which promotes diversification and reduces concentration risk.

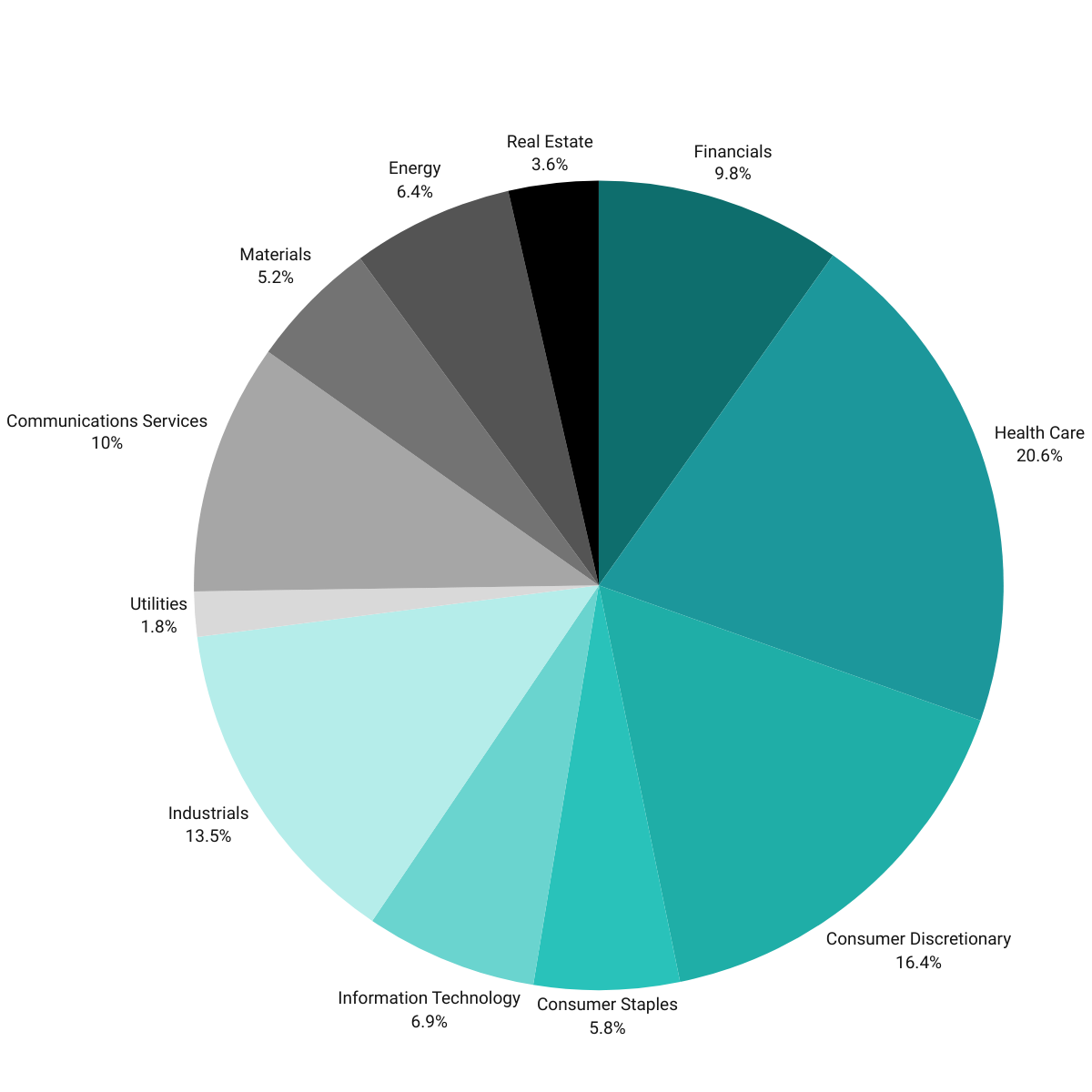

Sector risk overlay

The strategy employs a sector risk overlay, which means it diversifies its holdings across different industry sectors. This diversification helps mitigate risk by reducing exposure to a specific sector's performance and potential market shocks affecting that sector.

Provides investors with exposure to a broad cross-section of the U.S. economy.

Offers the potential for high long-term returns and acts as an inflation hedge.

As of January 11, 2024

Inception date: January 06, 2021

|

|

Year 1 | Year 2 | Year 3 |

|

aisot AI/ML 10 S&P 500 |

-15.4% | 23.1% | 2.5% |

|

S&P 500 |

-18.9% | 23.1% | 2.0% |

Sector Distribution (since inception)

Please leave your coordinates below so that we can contact you.

ZURICH / LONDON, 06.02.2026 — Aisot Technologies, the ETH Zurich spin-off specializing in AI-driven...

AI is reshaping how institutional investors work. At a World Economic Forum roundtable in Davos,...

2025 was an exciting and transformative year, marked by growth, new partnerships, continuous...