Aisot Technologies Launches LLM-Based Investment Co-Pilot and Time-Boxed LLMs

Media Release

Aisot Technologies has launched the Investment Co-Pilot alongside its world-first Fine-Tuned and Time-Boxed Large Language Models (LLMs). aisot’s time-boxed LLMs address the challenge of look-ahead bias in financial forecasting, while the Investment Co-Pilot provides users with seamless interaction with aisot’s suite of AI-powered quantitative tools through an intuitive LLM-based chat interface.

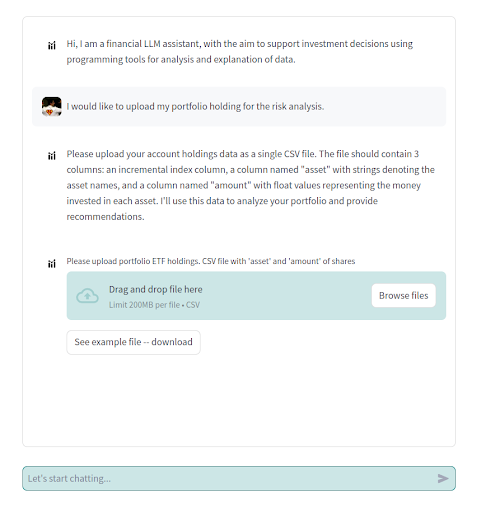

Introducing the Investment Co-Pilot: Real-Time, LLM-Driven Investment Support - aisot’s new Investment Co-Pilot is a powerful LLM-driven tool supporting investment decisions at every stage—from portfolio construction to analysis and rebalancing. Built on the open-source Llama 400B, the Co-Pilot delivers portfolio analysis through a user-friendly chat interface. Unlike generic applications like ChatGPT, the Co-Pilot continuously interacts with aisot’s AI-powered quant tools, validating outputs to maintain accuracy and relevance. Custom optimization solvers further adapt the tool to meet specific client requirements, streamlining and enhancing the investment process.

Fine-Tuned and Time-Boxed LLMs for Reliable Insights - aisot’s fine-tuned, time-boxed LLMs generate predictive sentiment factors that provide reliable, bias-free insights for backtesting and decision-making. The pioneering time-boxing technique restricts model training to data available at the prediction point, mitigating look-ahead bias and ensuring insights reflect actual market conditions. This innovation is accessible to clients via the AI Insights Platform or as a downloadable model for seamless integration into existing machine learning workflows. Updated quarterly to align with fiscal periods, aisot’s models leverage encoder-based transformers tailored for financial applications. To further enhance reliability, the time-boxed LLMs integrate with quantitative models under strict portfolio constraints, blending sentiment data with Bayesian uncertainty frameworks. This comprehensive approach prevents hallucinations and minimizes look-ahead bias, delivering real-time, actionable insights aligned with each client’s risk model.