Aisot Technologies Launches World-First Time-Boxed LLMs to Overcome Look-Ahead Bias for Investment Strategy Optimization

Aisot Technologies, a leader in AI-driven investment solutions, has introduced a groundbreaking feature: time-boxed large language models (LLMs). This innovation is now available on their AI Insights Platform or as a downloadable model for seamless integration into clients' machine learning operations.

The new feature allows clients to enhance their investment strategies while addressing key challenges like look-ahead bias. This world-first innovation tackles the issue of look-ahead bias, a common problem in financial forecasting and decision-making, by implementing time-boxing—a technique that adds checkpoints to the LLM pipeline to ensure investment insights are based on data available only at the moment of prediction. By eliminating the possibility of using future data in historical modeling, aisot’s time-boxed LLMs ensure more reliable and unbiased insights for backtesting tasks and decision-making.

Currently, the models are fine-tuned quarterly, in alignment with fiscal quarters. Built on a pre-trained language model (an encoder-based transformer), these models are optimized for financial tasks, particularly return predictions over defined time horizons. This ensures that the output can serve as LLM-derived sentiment factors in quantitative models for expected return forecasts.

To prevent hallucinations—incorrect or irrelevant outputs often seen with LLMs—aisot has implemented several safeguards. A key mechanism is time-boxing, which introduces checkpoints throughout the LLM pipeline to ensure that only real-time, historical data informs predictions. In addition to this, aisot combines LLM-derived sentiment data with quantitative models and machine learning algorithms, incorporating Bayesian uncertainty frameworks for more dependable outputs. By integrating LLM outputs with machine learning systems and portfolio optimizers that follow strict constraints, aisot ensures compliance with client-specific risk models and portfolio limitations. This robust approach helps mitigate hallucinations, look-ahead bias, and delivers high-quality, actionable insights for confident investment decisions.

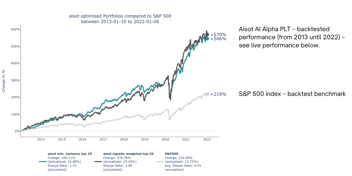

Aisot’s AI Insights Platform combines these advanced LLM-driven sentiment signals with quantitative models and machine learning algorithms. The result is a powerful tool for asset managers, funds, and investors to anticipate market trends, mitigate risks, and optimize investment strategies. “We’re proud to offer this unique solution to our clients, enabling them to make decisions based on real-time data without the distortions caused by look-ahead bias,” said Stefan Klauser, CEO of Aisot Technologies. “This innovation furthers our mission of empowering investors with AI-driven insights that are precise, actionable, and reliable.”

Aisot Technologies continues to lead the way in the integration of AI and financial decision-making, delivering cutting-edge tools that transform investment strategies at scale.