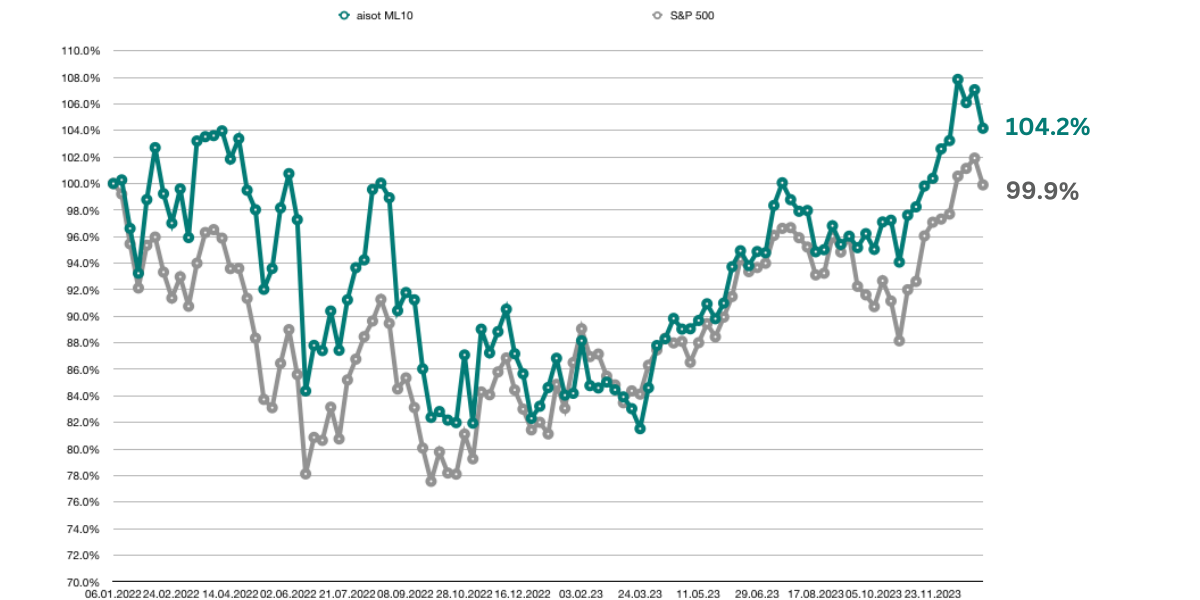

aisot’s ML10 S&P 500 Equity Portfolio: Two Years of Demonstrating AI’s Capabilities in Investing

Today marks the two-year anniversary of aisot's ML10 portfolio, a period highlighting its notable performance. In its first year, ML10 impressively outperformed the S&P 500 by 3.5%. The second year saw it match the performance of the S&P 500. However, what truly sets ML10 apart is its ability to mirror market performance with a highly selective approach, investing in just 10 well-diversified titles. This demonstrates that even within restrictive settings, ML10 can achieve market performance, showcasing the prowess and potential of AI.

The remarkable success of aisot's AI-driven ML10 portfolio in mirroring market performance with a highly selective approach is not just a testament to the prowess of AI in finance; it's a beacon for the future of personalized investment solutions. The ability of the ML10 portfolio to achieve market-like results with only 10 stocks demonstrates a significant leap in AI's capacity for precision and efficiency in stock selection. This success goes beyond mere performance metrics; it opens up a new realm of possibilities for personalized investment strategies, especially appealing to investors with specific constraints or preferences.

The ML10 portfolio offers the flexibility to introduce additional layers of downside protection, such as the incorporation of a risk-free asset. This additional feature allows for even greater customization of the investment approach, providing investors with an option to balance potential returns with their individual risk tolerance.

In the traditional investment landscape, achieving a balance between personalized investment goals and broader market trends can be challenging. However, ML10's AI-driven approach is proving to be a game-changer. The AI system's ability to sift through vast datasets, predict market movements, and select a minimal yet effective set of stocks is a clear indication of its potential to tailor investment strategies to individual needs. This capability is invaluable for investors who are looking for targeted investment approaches, be it for ethical reasons, such as ESG-focused investing, or compliance with specific regulatory requirements.

Moreover, the adaptability and relevance of ML10's approach suggest that AI can create scalable, personalized investment solutions that do not compromise on market performance. This is particularly significant in a dynamic financial world where investor needs and market conditions are constantly evolving. The AI-driven strategy embodied by ML10 thus paves the way for a new era in finance, where investment portfolios are not only personalized and risk-adjusted but also capable of delivering robust performance. This blend of personalization and performance is what positions AI as a cornerstone in the future of investment management, offering solutions that are as unique as the investors themselves.