“No-Code” AI empowering asset managers

No-Code AI enables asset managers to leverage the power of data and AI without requiring programming expertise. It provides a user-friendly interface for identifying trends in capital markets and constructing machine learning models, allowing asset managers to focus on portfolio management while achieving quick wins with AI.

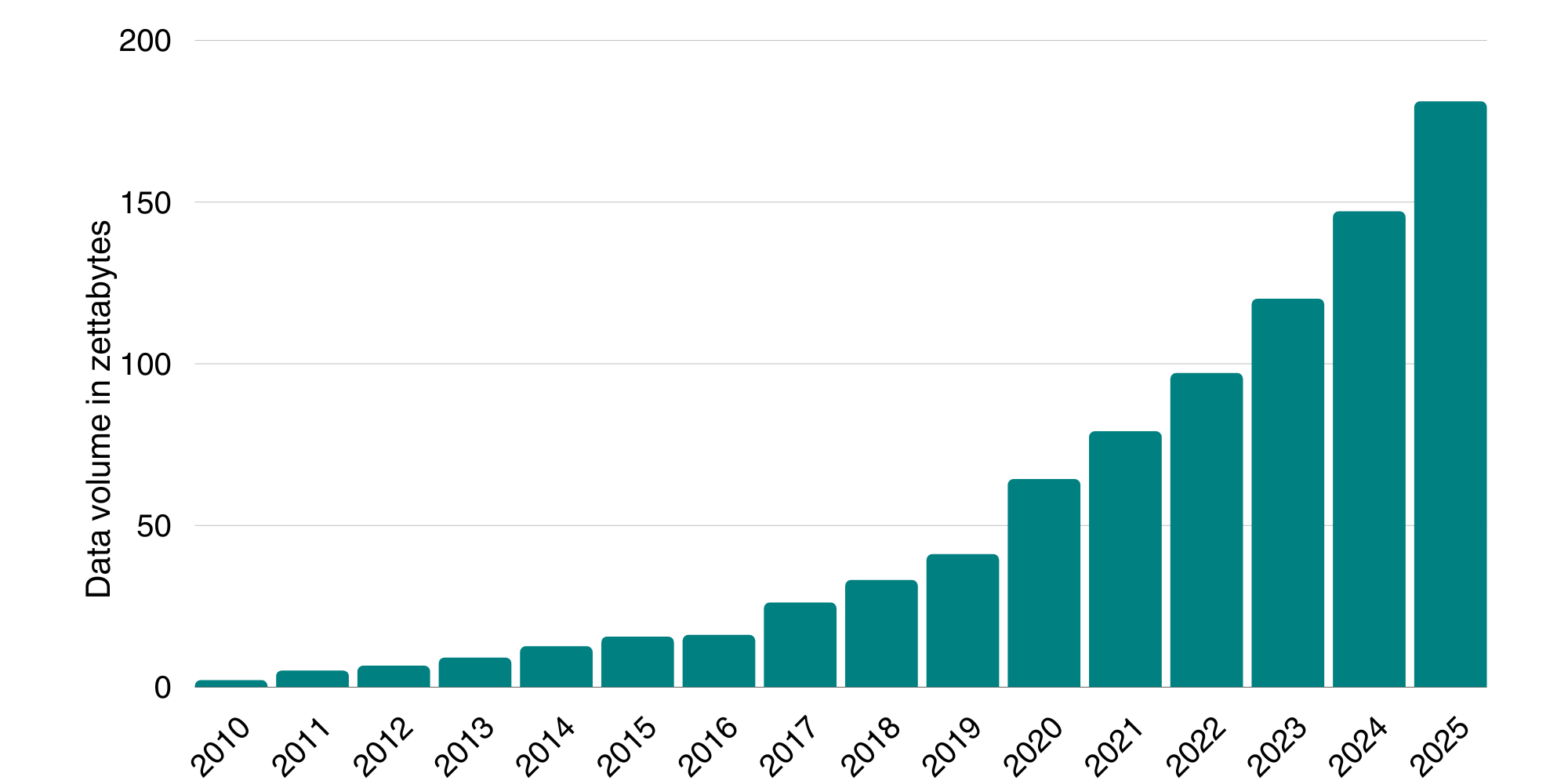

Data is growing rapidly today, at an almost exponential rate. The total amount of data created, captured, copied, and consumed globally reached about 64.2 zettabytes in 2020. Until 2025, global data creation is projected to grow to more than 180 zettabytes. As a reminder, a petabyte is 1000 terabytes of data, and a terabyte is equal to 1,024 gigabytes (GB), which itself is equal to 1,024 megabytes (MB), while a megabyte is equivalent to 1,024 kilobytes. For those among us old enough to remember floppy disks, a petabyte is 343 million floppy disks.

Source: Volume of data/information created, captured, copied, and consumed worldwide from 2010 to 2020, with forecasts from 2021 to 2025, Statista

Given the vast expanse of available data today, the potential to transform it into valuable insights can be hindered by the ease of utilization and interpretation. This challenge becomes even more critical for investment professionals, as every piece of information holds significance. One way to cope with the challenge for asset managers is to use no-code AI.

Forbes recently defined No-Code AI as a term that is “simply used to refer to tools that allow anyone to create AI applications without having to get their hands dirty writing technical code. AI can be useful to anyone in just about any job – from doctors and lawyers to marketers, teachers, and project managers. Many of these people will not have the technical skills needed to write code or the spare time to learn them.”

No-Code AI allows asset managers to tap into AI’s full potential

Data often presents challenges due to its inherent noise, lack of structure, and difficulty in mapping. Popular forms of alternative data include social media information, ESG (Environmental, Social, and Governance) data, or product reviews. While each type may hold intrinsic value and be of interest to asset managers, comparing them directly becomes a complex task. To extract meaningful insights from the abundance of available data, asset managers are increasingly relying on data scientists and machine learning engineers, competing with tech giants like Google, Microsoft, and Amazon for scarce talent resources. However, with the emergence of no-code systems, investment managers can achieve data-driven outcomes without the need for programming expertise.

By leveraging a user-friendly no-code system, asset managers can effortlessly harness the power of data to identify trends within capital markets. Our AI Insights Platform is specifically designed to be no-code and readily deployable. Within moments, asset managers can leverage their financial expertise to construct machine learning equity models and test various investment hypotheses. By embracing a no-code system, asset managers gain the advantage of immediately harnessing the power of AI. Freed from the burdensome tasks of coding and data cleansing, asset managers can readily utilize the aisot AI Insights platform to concentrate on their core strength – portfolio management. The ease of achieving quick wins with AI through no-code platforms facilitates the expansion of an organization's AI capabilities and teams, ultimately propelling success through the application of artificial intelligence.

No compromise on performance

When considering the adoption of a no-code solution, it is essential not to compromise on performance. While the aisot AI Insights Platform offers a user-friendly interface that can be intuitively grasped by individuals with finance expertise, it is also underpinned by highly intricate and robust components such as advanced data cleansing, machine learning, deep learning, quant finance and natural language processing.

While many of our clients have never written a single line of code, we also cater to a group of quant power users who possess the skills to develop their own machine learning programs. Despite their proficiency, these teams acknowledge the value of a no-code solution as it provides an easy and efficient means to test theories and assess the value of alternative data.

If you are interested in discovering more about incorporating no-code AI to elevate your investment process, contact us.