Understanding Diversification and Risk-Return Dynamics

In investment management, the foundational principles of diversification and the risk-return trade-off are crucial for professional investors aiming to optimize their portfolios. Grounded in the pioneering work of Nobel Laureate Harry Markowitz, these concepts not only serve as the bedrock of modern portfolio theory but also offer a strategic framework for managing financial risk and achieving investment objectives efficiently.

Diversification is more than a mere risk-avoidance tactic; it is a strategic imperative for the savvy investor. The adage “don’t put all your eggs in one basket” captures the essence of diversification but barely scratches the surface of its strategic importance. In practice, diversification involves allocating investments across various asset classes, markets, and sectors to mitigate the idiosyncratic risks associated with individual investments.

Strategic Diversification Tactics

Investors continuously pursue strategies that mitigate risk while optimizing return potential. Strategic diversification stands out as a nuanced approach to achieving a resilient portfolio. This method extends beyond conventional wisdom, deploying a multifaceted strategy designed to enhance returns and provide robust protection against market fluctuations. Key components of such a strategy encompass asset class variability, global exposure, sectorial spread, and correlations. Let's delve into each of these critical areas:

- Asset Class Variability: Incorporating a mix of stocks, bonds, commodities, and alternative assets to exploit their varying risk and return profiles.

- Global Exposure: Investing in international markets to capitalize on diverse economic growth patterns while cushioning against domestic market volatilities.

- Sectorial Spread: Allocating capital across different sectors to hedge against sector-specific downturns and leverage growth in others.

- Correlations: Investing in assets that exhibit low or negative correlations with each other, thereby reducing overall portfolio risk and smoothing out returns across different market conditions.

Risk-Return Trade-off: Leveraging Markowitz’s Portfolio Theory

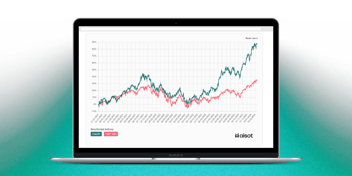

Harry Markowitz’s portfolio theory revolutionized investment strategy by formalizing the relationship between risk and return. His insights are particularly relevant for investors who seek to maximize returns without commensurate increases in risk exposure. According to Markowitz, the efficient frontier represents an optimal set of portfolios offering the highest expected return for a given level of risk.

Efficient Frontier

Aisot implements Markowitz's Portfolio Theory by integrating elements into its investment strategies, ensuring robust portfolio management for its clients. Firstly, through Quantitative Risk Management, Aisot applies advanced analytics and machine learning to accurately quantify and manage risk, enabling the construction of portfolios that closely align with individual investor's risk tolerance levels. This approach ensures that each portfolio is customized to meet specific investment goals while effectively managing potential volatility. Secondly, Aisot employs AI-and Quant-based Portfolio optimization techniques, leveraging machine learning algorithms to analyze massive datasets, including market trends, historical prices, and economic indicators, enabling the prediction of asset behavior with a higher degree of accuracy. By employing these novel approaches, investment firms can construct portfolios that are highly optimized for risk and return. These AI-driven models are capable of identifying complex patterns in the data that are imperceptible to human analysts. This allows for the construction of investment portfolios that not only meet the specific financial goals and risk tolerance of individual investors but also adapt dynamically to changing market conditions. The application of AI and quantitative methods enhances the decision-making process, ensuring that the portfolios remain on the efficient frontier, thus maximizing potential returns for any given level of risk. This approach represents a significant leap from traditional portfolio management, moving towards a more systematic, data-driven strategy that can operate with speed, efficiency, and scalability.

In addition to these strategies, Aisot places a strong emphasis on regular portfolio review and rebalancing. This practice is crucial as it helps in adjusting the portfolios to reflect changes in market conditions, financial goals, and risk appetite. By continuously monitoring and adjusting the investment allocations, Aisot ensures that the portfolios maintain their alignment with the efficient frontier over time, thereby adhering to the principles of Markowitz's framework while catering to dynamic market environments and client needs. This comprehensive approach not only enhances investment performance but also fortifies the investment process against unexpected market shifts.